Choosing insurance for a baby might sound strange at first. But when the plan grows with your child, it starts to make sense. The Gerber Life Grow-Up Plan locks in a low rate early. It doubles the coverage when your child turns 18. It also builds steady cash value over time. This review explains what the plan actually offers. It also shows where it might be more than you really need.

Read More: Why Burial Insurance for Seniors Matters: Key Insights and Tips

What Is the Gerber Life Grow-Up Plan?

The Gerber Grow-Up® Plan is a whole life insurance policy. It is made specifically for children and is available for kids from 14 days old. Coverage is available till 14 years. You can choose coverage amounts between $5,000 and $50,000. The amount depends on what you want to protect.

This plan is different from term policies. Term policies expire but this plan is designed to last a lifetime as long as premiums are paid. The premium is fixed even if some sort of health condition develops in future.

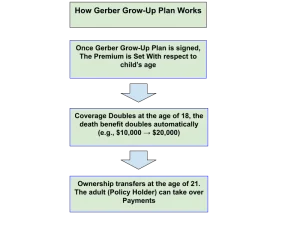

How the Gerber Life Grow-Up Plan Works

First, you buy the policy. Your child’s age determines the monthly premium. That rate is locked in for life. It never increases even as the child becomes an adult. When your child turns 18, the death benefit automatically doubles. For example, $10,000 becomes $20,000. You do not pay anything extra for that increase.

This policy is a whole life policy. Part of each premium goes toward a cash value account. This cash value builds up over time. It builds up slowly. After a few years, you or your child can borrow against it. You can also withdraw from it. But you must be cautious. Loans have interest, often around 8%. Unpaid loans reduce the death benefit.

The policy ownership transfers to the child at age 21. From that point onward, they have options whether to continue paying premiums to keep the coverage. Or, they can choose to surrender the policy. If surrendered, they receive the cash value.

There is one important extra feature. The policy includes guaranteed insurability options. Your child can buy more coverage as an adult. They can buy up to 10 times the original amount. This is done at standard adult rates. No medical exams or health questions are needed but subject to certain timing rules.

The Pros of the Gerber Life Grow‑Up Plan

Every plan has positive and negative sides, let’s discuss pros of the plan!

1. Guaranteed Coverage for Life

When you start this plan, your child gets lifelong protection. You just need to keep paying the premiums. The coverage never ends. It gives peace of mind that stays with them.

2. Coverage Doubles at Age 18

At age 18, the coverage doubles automatically. If it was $10,000, it becomes $20,000. You don’t have to pay extra. The plan simply grows on its own.

3. Cash Value You Can Access

Each month, a small part of your payment becomes savings. This savings builds up over time. Your child—or you—can borrow from it or take it out if needed. It offers extra help when life gets tough.

4. An Affordable Start

The plan is budget-friendly from the start. If your child is young, it can cost just a few dollars a week. Once the rate is set, it stays the same forever. That makes it easy to manage.

5. Future Coverage Is Guaranteed Even with Health Issues

When your child turns 21, they take over the policy. They can keep it for life if premiums are paid. They can also add more coverage later without a medical exam. It doesn’t matter if their health changes.

The Cons of the Gerber Life Grow‑Up Plan

Although Gerber Life Grow‑Up Plan has many benefits but it comes with limitations too. Let’s discuss them in details!

1. Weak Cash Value Growth

The savings component in the plan grows very slowly. Even after decades, you’ll likely get back less than what you paid in premiums. Financial experts say mutual funds or even CDs could grow more in value over time. Many families find better returns elsewhere.

2. Kids Rarely Need Life Insurance

Children usually don’t have financial responsibilities that require insurance—like supporting a family or paying off a mortgage. Experts argue that investing in savings or a college fund could be more practical. Many financial advisors recommend simpler methods over policies like this.

3. Pricier Than Competitors

Gerber’s rates are often much higher than similar child policies from other providers. You may pay twice as much monthly for the same coverage. Some critics call it expensive insurance in disguise.

4. Tricky Fine Print

The policy looks straightforward, but the fine print can be complicated. If your child wants more coverage later, they must request it at very specific ages or life events—and in narrow windows. You can’t just request the full amount at once. Many find it restrictive and confusing.

5. Restricted Increase Options

There’s a limit on how often and when your child can use the Guaranteed Purchase Option. Coverage increases must happen around anniversaries or milestones (like marriage or parenthood). If those windows are missed, you may lose the chance entirely.

Who Might Benefit from the Gerber Life Grow‑Up Plan?

Parents or grandparents who want lifelong insurance for their kids, with simple fixed costs and guaranteed coverage can benefit from Gerber Life Grow-up Plan.

1. Families Concerned About Health Risks

If your child or grandchild has health conditions, this plan can bring peace of mind. It’s also helpful if there’s a family history of illness. You can lock in a low rate while they’re still young. Their coverage is guaranteed, even if their health changes later. They don’t need a medical exam to add more coverage in the future. Health risks won’t block them from lifelong protection.

2. Budget‑Tight Parents Who Want Lifelong Security

This plan offers very low premiums for children. In many cases, it only costs a few pennies a day. Once you lock in the rate, it never increases. That gives lifelong protection at a price most families can manage. Parents who want simple, stable financial planning often find this helpful.

3. Grandparents Looking for a Meaningful Gift

Many grandparents buy this plan as a lasting gift. It locks in coverage while the child is young. At age 21, the child becomes the policy owner. This gives them protection and a sense of security. For many grandparents, it’s a way to say, “I’ll always be there for you.”

4. Estate Planners Seeking Predictability

Some families need help with long-term financial planning. This plan can be part of a larger estate strategy. It can help balance future assets or address possible tax issues. It’s a steady, predictable choice. It fits well into broader legacy plans.

Alternatives to the Gerber Life Grow‑Up Plan

If you’re thinking differently about savings or protection, here are some popular choices that might fit your family’s goals better:

1. Child Rider on Your Adult Life Insurance

You can simply add your child to your existing life policy with a “child rider.” It gives them a small amount of coverage; often around $10,000; for a low extra premium. There’s no cash value, and the coverage ends when the child reaches adulthood. It’s cheaper and simpler than buying a separate policy.

2. 529 College Savings Plan

This plan lets your money grow tax‑free for college costs. Withdrawals are also tax-free when used correctly for school expenses. It typically outpaces cash value life policies in growth. But if funds aren’t used for education, penalties or taxes may apply. And the balance may impact financial aid.

3. High-Yield Savings or Mutual Funds

For some parents, a simple high-yield savings account or a low-cost mutual fund makes sense. Your money can grow faster than life insurance cash value. You can access it anytime. It’s flexible and avoids insurance fees—but comes with market risk.

4. Roth IRA for Kids

This is less common but flexible. If your child has earned income, they can open a Roth IRA. Contributions (not earnings) can be withdrawn tax-free at any time. It’s typically intended for retirement but can help fund education or emergencies later.

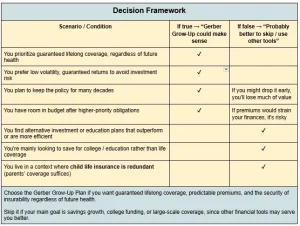

How to Decide If the Gerber Life Grow-Up Plan Is Right for You

Follow this decision framework to check if its suits you or not!

If you want guaranteed coverage for your child with fixed costs and lifelong protection, this plan may be a good fit. But if your goal is higher savings growth or large-scale coverage, other options could serve you better.

Is the Gerber Life Grow-Up Plan Worth It?

If your goal is to give your child lifelong protection, the Gerber Life Grow-Up Plan could be a good fit. It offers coverage that stays with them no matter what life brings. That alone can feel deeply reassuring. This plan can be especially helpful if you worry about future health problems. Some conditions could make getting insurance harder later.

The plan itself is easy to understand. It grows slowly. But it does grow. It’s not designed to replace college savings or big investment plans. Instead, it offers quiet, steady security. If you’re okay with that kind of trade-off, it could be a comforting choice. It gives you a safety net that grows with your child. For many families, it’s not just about money or coverage. It’s about care. It’s about love—wrapped in a policy.

FAQs

Is the Gerber Life Grow-Up Plan really a good way to protect my child’s future?

If you want long-term security for your child, this plan can help. It locks in life insurance while they’re still young. It does this before any health issues can appear later. It won’t make you wealthy, but it gives peace of mind. That protection stays with your child for life. For many parents, that kind of quiet security means everything.

Does the plan actually grow in value over time?

Yes, the plan does grow. It grows slowly, but it keeps building. A small part of your monthly payment turns into savings. That savings is called cash value. Over the years, it adds up. It may not grow as fast as college or investment funds. But it can still give your child some extra financial help later.

What happens when my child turns 21?

When your child turns 21, the plan becomes theirs. They now own the policy. They take over the payments and the coverage. They can also add more coverage later. They won’t need a medical exam to do that. Even if their health changes, they can still get more insurance. That can be very helpful as they grow up.

Are there better alternatives if I just want to save for college?

Yes, there are other options for college savings. A 529 plan or high-yield savings account may be better. These grow faster. They also come with tax benefits. But they don’t offer lifelong coverage. If you want both savings and insurance, the Gerber plan can help with that. It offers a balanced option.

Is it too expensive compared to other options?

That depends on what you compare it to. The monthly cost is low. It might only cost a few dollars each week. But other options, like child riders or different insurers, may charge less. Still, this plan offers guaranteed coverage. It also gives flexibility. You won’t see fast growth, but you’ll have steady protection. For many families, that feels worth the price.