We plan vacations, weddings, and new phones. But we rarely plan to lose our income. That one thing could stop all the plans you make. Income protection and disability insurance do not sound exciting. But they are really important in times of need. They help keep your plans alive.

Let’s discuss them in detail!

Read More: How to Find the Best Used Car Insurance

What Is Income Protection Insurance?

Income protection insurance pays you a regular income if you can’t work because of sickness or disability and continues until you return to paid work or you retire. Income protection insurance is also known as permanent health insurance.

Here is how it works:

You pay a regular premium. If you get too sick to work, the policy pays you a monthly benefit. This payment usually starts after a “waiting period.” It continues until you get better or the policy ends. Most policies cover 50% to 70% of your income before taxes. This money is meant to cover your basic costs. It does not fully replace your salary.

This insurance is very useful for people without employer benefits. Professionals, freelancers, and self-employed people often buy it.

The plus point of Income Protection Insurance includes a steady income. You can focus on getting better without being worried about money. It can also be a long-term solution. Some policies pay for years.

On the other hand income protection insurance can be expensive especially for older people or those having risky jobs. There is also a waiting period before payments start. Some policies have strict rules on what “unable to work” means.

What Is Disability Insurance?

Disability insurance is a type of insurance that provides income in the event that a policyholder is prevented from working and earning an income due to a disability.

In the U.S., there are two main types. One is called short-term disability (STD). It is temporary and gives you benefits for a few weeks or a few months. Payments start quickly after a short waiting period.

The second type is long-term disability (LTD). This is for more serious or lasting conditions. Payments usually start after short-term benefits end. It can last for many years, in some cases, till the retirement

Both policies replace about between 40% and 60% of your income. This money is meant to help with your basic living costs when you cannot work.

You can get this insurance in two ways. Many employers offer group policies as a benefit. You can also buy a private policy on your own. Private policies often cost more. But they are portable. You can take them with you if you change jobs. They also tend to have a better definition of “disability.”

Key Similarities Between Income Protection and Disability Insurance

“Income protection insurance” and “disability insurance” are similar. They both have the same main goal. They protect you financially when you can’t work due to an unexpected illness or injury.

Here are the main similarities:

- They both replace lost income. The main job of both policies is to give you money that replaces part of your normal salary. This is your main protection.

- They help cover important expenses. The money you get can be used for rent, bills, groceries, and other daily costs. It lets you keep your lifestyle while you recover.

- They reduce financial stress. Having a safety net helps a lot. It lowers the worry that comes with being out of work and lets you focus on getting healthy.

- You can buy them as individual policies. You can buy both types of insurance yourself. It means you can have coverage even if your job doesn’t offer it. You can also add to a plan your employer already gives you.

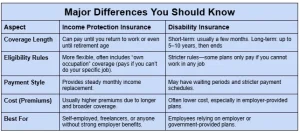

Major Differences You Should Know

While both types of insurance have the same purpose, they have some important differences. These differences can change which policy is best for you.

The Key Difference in Coverage

The biggest difference is how long they pay you. Income protection insurance is often for a long time. It gives you a steady income until you can work again or until the policy ends. This can be as late as your retirement age. Disability insurance has more fixed periods. Short-term disability might only last a few months. Long-term disability can last for years. But it often has a maximum term, like 5 or 10 years. After that, it stops paying.

Eligibility and Payment Style

Disability insurance rules can be strict. Employer or government plans often make you prove you cannot work in any job at all before they pay benefits. For example, if you were a surgeon but could still work as a teacher, they might not cover you.

Private income protection insurance is usually more flexible. Many of these plans use an “own occupation” clause. That means you qualify for benefits if you cannot do your specific job—even if you could work in another role. Using the same example, if you can no longer perform surgery, the policy may still pay you, even if you could teach or do office work.

Payments also work differently. Income protection policies usually provide a steady monthly benefit to replace part of your lost income. Some disability insurance plans, however, may require you to wait longer before benefits start. They can also have stricter schedules for when and how payments are made.

Cost and Who It’s For

Income protection insurance can have higher premiums. A premium is the money you pay for the insurance. This is because income protection often has broader coverage. It can also pay for a longer time. This makes it a popular choice for self-employed people. It is also good for freelancers. They do not have an employer’s sick leave or disability plan. Many U.S. workers depend on their employer’s plan. But this might not be enough. Getting a private income protection policy can add to that plan. It gives you more complete coverage.

Comparison Table

How to Decide Which Is Right for You

Deciding between these two types of insurance can feel hard. The best choice depends on your situation and your financial needs. Here are some key things to think about that will help you make a good decision.

1. Your Job Type and Employer Benefits

Think about your job. If you are a freelancer or contractor, you probably don’t have a safety net. An individual income protection policy is a smart choice for you. It provides a reliable safety net. You are in charge of it. You do not have to depend on anyone else.

If you are a corporate employee, check your company’s benefits. Many employers offer long-term disability (LTD) insurance. But it might not be enough. You might want to buy a private income protection policy. This can add to your employer’s plan. It can give you better coverage. It might also have a better definition of “disability.”

2. Your Financial Situation and Health

Do you have a lot of savings? If so, you might be able to handle a waiting period. This is the time before your benefits start. If you do not have savings, a policy with a shorter waiting period might be worth the extra cost.

Also, think about your health. Are you young and healthy? Your payments will be much lower. This is a good time to get a policy. Do you have a health condition or a risky hobby? This could affect if you can get coverage or how much you pay.

U.S. Market Costs & Availability in 2025

When you look at the costs of income protection and disability insurance, it’s clear the price is not the same for everyone. This depends on many factors.

Average Monthly Costs in 2025

- Income Protection Insurance: This can cost between $50 and $200 a month. The price is higher because it has better coverage. It can also pay out for a longer time.

- Short-Term Disability: Costs are usually lower. They average between $20 and $80 a month. This is because the coverage period is shorter.

- Long-Term Disability: This policy is in the middle. It generally costs $50 to $150 a month. The price depends on how long the payments last.

What Changes the Cost?

Many things affect your specific cost.

- Age and Health: The younger and healthier you are, the less you will pay. As you get older, the risk of illness goes up. Your rates will also go up.

- Occupation: Your job’s risk is a big factor. A person with a desk job will pay much less. A construction worker or pilot will pay more.

- Coverage Amount and Term: Do you want to replace more of your income? Do you want the policy to pay for a longer time? If so, your payment will be higher.

It’s also important to know the difference between private policies and government programs. Social Security Disability Insurance (SSDI) is a federal program. It offers a safety net. But it can have a very strict definition of disability. It also has a long waiting period. Private policies give you more choices. They can be a good addition to SSDI. They provide a stronger safety net.

FAQs About Income Protection Insurance vs. Disability Insurance

What’s the main difference between income protection and disability insurance?

Income protection gives ongoing monthly coverage. Disability insurance gives short-term or long-term benefits. The benefits are fixed and clearly defined.

Can you have both income protection and disability insurance?

Yes, you can. Some people use both. This helps cover immediate risks. It also covers long-term risks. It is useful if an employer plan has gaps.

How much income does each type replace?

Income protection can replace up to 70% of your income. Disability insurance usually replaces 40% to 60%. The exact amount depends on the provider. It also depends on the policy.

Are these insurances tax-deductible in the U.S.?

Employer-paid disability insurance is not taxable to you. It may affect the benefits you receive. Premiums for income protection that you buy yourself are not deductible. But the benefits from these plans are usually tax-free.

Who needs income protection or disability insurance the most?

Self-employed workers benefit the most. People in high-risk jobs also need it. Families with large financial commitments should consider it. Anyone who depends on their paycheck should think about getting one or both.