Not all trucking insurance policies are the same. Some operators rely on Regular Trucking Insurance that offers only basic protection like primary liability and limited coverage for damage. Others choose Total Trucking Insurance that is a comprehensive, bundled solution. It covers liability, cargo, physical damage, and more. It puts all coverage under one umbrella. The differences between Regular Trucking Insurance and Total Trucking Insurance go beyond what’s written on paper. When an accident or claim happens, those differences can decide whether you stay financially secure or face huge out-of-pocket costs.

Many fleet owners lose money over time without knowing it. They rely on incomplete coverage and juggle multiple separate policies. Coverage gaps, overlapping premiums, mismatched renewal dates, and denials due to non-coordinated policies can erode revenue and expose you to major risk.

In this guide, you will learn something important. You will learn why a comparison matters. More importantly, you will learn which insurance setup saves more over time.

Read More: The Best CTP Insurance Providers in US for 2025

What Is Regular Trucking Insurance?

Regular trucking insurance refers to a baseline package. It is a standard coverage package designed to protect truck operators against the most common risks on the road. At its core, it includes primary liability, bodily injury and property damage to others. It also includes physical damage protection that covers collision, theft, fire, or vandalism to your own vehicle. In many cases, it may also include minimal cargo coverage that protects against minor freight losses. These core coverages are similar to standard commercial auto insurance. This is what small operators might also carry, especially for lighter-duty trucks and regional routes.

However, regular trucking insurance has important limits. It typically does not cover non-trucking use like personal errands or off-duty travel. It offers only limited cargo protection and excludes specialty or high-value freight. It provides less flexibility for fleets. For example, it has fewer built-in endorsements like bobtail, trailer interchange, or umbrella protection. Policies are often segmented. Operators may end up managing multiple insurance contracts. This increases the chance of gaps or coverage conflicts.

In short, regular trucking insurance is suitable for basic operations. However, it lacks robust protection. This robust protection is needed to handle complex exposures. This includes full-scale freight or interstate trucking.

What Is Total Trucking Insurance?

Total Trucking Insurance is a bundled policy solution. It is an all-in-one policy that is designed to cover nearly every risk a trucking operation faces under a single umbrella. This approach is better than managing separate policies. It combines many coverages into one contract. These coverages include liability, cargo, physical damage, general liability, bobtail/non-trucking, and trailer interchange.

The advantage is consolidation. This means one premium, one renewal date, unified claims handling, and fewer coverage gaps.

Total Trucking Insurance reduces the administrative burden because it bridges multiple exposures that helps prevent mismatches between separate policies. Claims are handled more smoothly because all involved coverages are with the same insurer. A bundled model also allows insurers to offer discounts and incentives for taking on the full spectrum of risk. This makes it more cost-efficient in many real cases.

Total Trucking Insurance unifies all major trucking coverages. It offers a smarter pathway to protection. It is also more efficient and often more economical. This benefits owner-operators and fleets.

Key Differences Between Total and Regular Trucking Insurance

Total Trucking Insurance may seem more expensive at first. However, its value is in reducing total loss exposure. It also cuts hidden costs over time. Managing multiple policies can lead to several issues when a claim happens like gaps and coverage conflicts. They also include delayed pay-outs which cause extended downtime. They cause revenue loss and lead to legal complications.

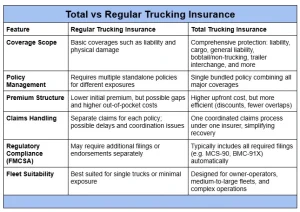

Let’s discuss the differences between the two in the following side-by-side comparison:

Over time, total coverage can save thousands. It saves on premium leakage, claim settlement friction, and contract rejections. This ultimately protects profit margins. It also protects business continuity.

Financial Impact – Which Option Actually Saves You More?

When comparing Regular Trucking Insurance versus Total Trucking Insurance, the real question is: what’s your total cost of ownership? That means going beyond premiums to account for deductibles, downtime, administrative overhead, and out-of-pocket claims costs.

According to the industry’s benchmark research, truck insurance premiums jumped 12.5% in 2023, pushing average insurance cost per mile to about $0.099. This is one of the largest increases among operating cost line items. Over the past decade, premiums have surged nearly 40%, further intensifying pressure on margins. For many fleets, insurance is no longer a fixed cost but variable that bites harder with every accident claim or litigation claim.

In contrast, fleets that bundle coverages tend to see efficiencies and savings. Some carriers report 5 to 25% savings annually by consolidating policies and reducing overlapping administrative and claims friction.

Hidden costs of regular coverage compound rapidly: gaps that insurers refuse to honor, rejected claims due to coverage conflicts, uninsured cargo losses, and loss of revenue from trucks being sidelined during claims. All of these can drain cash faster than any premium increase.

In practice, fleet owners choosing total trucking insurance often find it lowers their commercial truck fleet insurance expenses significantly over time.

How to Choose the Right Total Trucking Insurance Policy

Choosing the right insurance for your trucking business is a very important decision. A basic policy from a standard company is not enough. To get the best coverage, you must first understand your own business.

Assess Business Size, Fleet Size, and Cargo Type

First, assess your specific needs. Think about the size of your operation. Do you have a large fleet? Or are you an independent driver? What kind of freight do you carry? Hauling high-value goods like electronics needs different coverage. It is different from hauling general freight. Knowing these things helps you decide what coverage you need most.

Key Policy Features to Look For

When you look at different policies, pay close attention to the key features. Look for policies with high liability limits and strong cargo protection. Make sure they include physical damage coverage. This should fit the value of your trucks and trailers. Also, check for extra features. Downtime coverage can be a lifesaver if your truck breaks down.

Work with a Specialized Trucking Insurance Provider

It is also very important to work with a specialized trucking insurance provider. These companies understand the special risks of the industry. They can offer policies that are best for you which a general insurance company might not offer. They can also help you understand complicated rules. They can help you find a balance between a full policy and a price you can manage. Taking the time to find the right partner will save you money and problems later on.

Common Mistakes Trucking Businesses Make Without Total Coverage

Trucking businesses face many risks like major financial losses from accidents, cargo issues, and regulatory fines. To neutralize these risks a very good insurance policy is required. Let’s discuss the common problems which businesses make when signing their insurance.

Relying Only on Basic Liability Insurance

Many trucking businesses, especially new ones, make a costly mistake: they only get the bare minimum insurance required by law. This leaves huge gaps in their protection. The biggest blunder is relying only on basic liability insurance. While it covers damage you cause to others, it won’t pay a dime for repairs to your own truck or lost cargo.

Ignoring Cargo Coverage

Another common error is ignoring cargo coverage. The freight you haul is your livelihood, but without cargo insurance, a theft or a simple spill can result in a total financial loss. You are left responsible for the value of the goods, which can be devastating.

Underinsuring Drivers or Vehicles

Businesses also often make the mistake of underinsuring their drivers or vehicles. They might choose a policy with low limits to save money. But in today’s world of “nuclear verdicts,” a major accident could result in a lawsuit far exceeding those low limits, forcing the business into bankruptcy.

FAQs about Total Trucking Insurance vs Regular Trucking Insurance

What does Total Trucking Insurance include?

It bundles several coverages. It includes liability, cargo, and physical damage. It covers general liability and non-trucking use. All these are under one policy.

Can small owner-operators get Total Trucking Insurance?

Yes, they can. Most insurers now offer scalable total coverage. This is for single-rig owner-operators. They benefit from full protection and easy management.

What does Total Trucking Insurance include?

Total Trucking Insurance is a complete package. It covers much more than just basic liability. A full policy usually includes primary liability. This pays for damages to others. It also includes physical damage coverage for your truck and trailers. Motor truck cargo coverage is also included. This covers the freight you haul. It also often adds general liability and workers’ compensation. This gives you a full safety net against many business risks.

Is Total Trucking Insurance required by law?

Only the basic insurance level is required by law. This is called primary liability. It is required for most carriers and drivers. But getting only the minimum coverage leaves your business open to big financial risks. Total trucking insurance includes more coverage. This extra coverage is very important. It includes cargo and physical damage protection. These are key for real business safety and success.

How much does Total Trucking Insurance cost for fleets vs. owner-operators?

The cost of total trucking insurance is very different for each business. It depends on many things. These include your fleet size, the type of freight you haul, and your drivers’ safety records. In general, you will pay more if you have more trucks. You will also pay more if your cargo is worth more. It’s about finding the right balance. You need enough protection and a price you can afford.

Does trucking insurance cover cargo theft and accidents?

Yes, a total trucking insurance policy covers both of these. A key part of the policy is Motor Truck Cargo coverage. This protects your freight from theft, fire, or damage. Also, Physical Damage coverage pays for repairs to your own truck and trailer. This happens after an accident. This complete approach makes sure you are safe from common risks.

Is Total Trucking Insurance more expensive?

Upfront premiums can be higher. However, overall savings are greater. This is due to discounts and efficiency. It is also due to fewer uncovered claims.

How is Total Trucking Insurance different from Standard Commercial Auto Insurance?

Commercial auto covers general business vehicles. Total trucking policies are different. They are tailored for freight and fleets. They are also tailored for FMCSA compliance.

Which companies offer Total Trucking Insurance?

Major U.S. providers offer it. These include Progressive, Great West Casualty, Sentry, and Nationwide. They are known for their commercial fleet expertise.

How can I find the right provider for Total Trucking Insurance?

To find the right provider, you should work with an insurance company. This company should specialize in the trucking industry. These experts know the special risks you face. They can help you create a policy just for you. Look for a provider that offers custom features. They should also help you find the best balance between full coverage and a price you can afford.