Businesses around the world are dealing with big challenges that bring a lot of uncertainty. This constant change makes leaders look for ways to reduce pressure, build trust, and feel more secure. Because of this, topics like managing cash flow and handling risk are now top priorities.

For a long time, traditional indemnity insurance has been the main way to transfer risk. It has worked well to cover losses from fires and natural disasters. But the business world has changed. Companies now depend more on digital and intangible assets. Supply chains are more connected than ever. In this new setup, regular insurance often leaves dangerous gaps in protection.

In 2023, natural disasters caused $280 billion in losses worldwide. Out of this, only $108 billion was insured. That left a gap of $174 billion. Because of this, company boards are asking insurance managers to find new options that can cover risks traditional policies often miss.

This is why parametric insurance is gaining attention. These policies are linked to clear triggers, like wind speed or rainfall levels. When the event happens, the payout is fast and simple. It gives businesses quick relief and fills the gaps left by traditional insurance.

Read About: How Environmental Liability Insurance Can Protect Against Costly Claims

Understanding Parametric Insurance Coverage

At its core, parametric insurance is a type of cover that pays a fixed amount when a specific event happens, based on a clear index or parameter. For example, imagine a business in California wants protection against wildfires. A parametric policy could be designed to pay different amounts depending on how much area burns near that property. If wildfire activity reaches a certain threshold, the fixed amount is paid automatically. Suppose the policy is set so that if a fire burns within a 5-mile radius and consumes over 1,000 acres, the insurer pays $5 million. If it burns over 5,000 acres in the same zone, the payout might rise to $20 million. The trigger must be verified independently via satellite imagery and data from an official wildfire monitoring agency.

In contrast, traditional indemnity insurance would assess physical damage, verify destroyed structures, debris removal, and so on. That process might take months. But with this parametric wildfire approach, funds arrive quickly, often before full damage assessments finish, giving the business liquidity when it needs it most.

So the California fire example shows how parametric insurance can offer faster protection against risks that standard policies fail to address.

Current areas of cover

Parametric insurance can be used in many different situations. A few common examples are:

- Beachfront hotels in the Caribbean that need protection from hurricanes

- Oil and gas platforms in the Gulf of Mexico facing storm risks

- Retail businesses that want support when sales drop after a major earthquake

- Governments that need fast funds for relief after a disaster

- Car dealerships protecting against damage from severe hailstorms

- Companies adding extra benefits to help employees after natural catastrophes

Natural disasters are the simplest place to apply parametric insurance. This is because there is plenty of reliable data, such as earthquake readings or wind speed records. Due to extreme climate shifts globally, natural disasters are happening more frequently. Therefore, parametric insurance has become a top priority for many organizations looking for faster protection.

Explore More: Vendor Liability Insurance: Protecting Your Business from Third-Party Claims

Two Key Components of a Parametric Insurance Policy

The two main components of a parametric insurance policy are the trigger that activates the cover and the payout that is released when the trigger is met. Let’s discuss them in detail!

A Triggering Event

Parametric insurance cover activates only when a certain event or condition reaches the agreed level or gets exceeded. The trigger is measured by an independent and trusted source. In most cases, triggers are natural disasters like wildfires, hurricanes, floods, or droughts. But parameters can also be linked to things like crop harvests, stock market changes, or power cuts. To qualify, a trigger must happen unexpectedly, be monitored with reliable independent data, and be possible to model. The insured must also have a genuine financial interest in the outcome.

A Pay-out Mechanism

A pre-agreed pay out if the parameter or index threshold is reached or exceeded, regardless of actual physical loss sustained. For example:

- $12 million if an earthquake of magnitude 7.0 or higher happens in a defined area.

- $55,000 for every millimeter of rainfall above a chosen limit.

The threshold is usually set in such a way that aligns with a client’s own business continuity plan and risk tolerance. For example, a client may know that their business can sustain the effects of an earthquake below magnitude 7.0.

Traditional Insurance Vs. Parametric Insurance

Traditional insurance and parametric insurance play complementary roles in a risk transfer strategy.

Traditional insurance is mainly used to protect physical assets, such as buildings or equipment. It relies on standard risk assessment methods, contract terms, and established coverage options. After an event, payments are made based on the actual loss that has been assessed. The claim is subject to the terms and conditions of the policy. In most cases, the insured can only recover funds if there is clear physical damage. The payout is usually intended to repair or replace what was damaged.

Parametric insurance works differently. The payment is linked to the event itself, not the actual loss. This makes the scope of coverage much broader. Parametric insurance can protect against risks that traditional insurance cannot cover. For example, financial impacts or assets that are difficult to insure. It can also add extra coverage for natural events, such as hurricanes or windstorms, which are often a major concern for clients.

Key Differences

| Feature | Traditional Insurance | Parametric Insurance |

| Focus | Covers physical assets like buildings or equipment | Covers financial impact from an event, even without damage |

| Basis of Payment | Actual assessed loss after the event | Pre-agreed payout when trigger is met |

| Claims Process | Requires inspection, proof of damage, and can take months | Quick payout, often within days, no inspection needed |

| Coverage Scope | Limited to physical losses and policy terms | Broader, can cover hard-to-insure or excluded risks |

| Use Case | Repairs/replaces damaged property | Provides liquidity after disasters or economic disruptions |

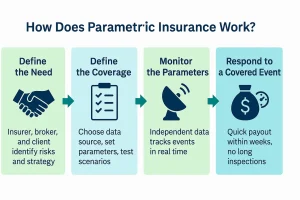

How Does Parametric Insurance Work?

To understand this insurance policy properly, let’s look at how parametric insurance works.

Define the Need

The process begins when the insurer, the broker, and the client sit together to identify what risk needs to be covered. They outline the scenario the policy should address and create a risk strategy. This includes deciding how much risk the client will keep and how much will be transferred, so the premium remains balanced and affordable.

Define the Coverage

In the next step, the involved parties agree on which independent data source will be used and what parameters will trigger the policy. These parameters are then tested against past events and possible future scenarios. This testing helps refine the design of the policy. The outcome of this step is a parametric insurance contract that meets the specific needs of the client.

Monitor the Parameters

Once the policy is active, the chosen parameters are constantly tracked. For example, a hurricane’s wind speed in a set location may be monitored by the agreed data provider to see if it passes the trigger level.

Respond to a Covered Event

If the data confirms that the trigger has been met or exceeded, and the client can show they suffered a financial loss, the payout is released. The pre-agreed funds are usually paid within weeks. Since there is no need for a long inspection of physical damage, the process is fast. The client receives cash immediately after loss to cover damages.

Key Drivers for Parametric Insurance

Let’s discuss the key drivers for Parametric Insurance.

Cover for Risks that are Hard to Insure

Example: Builders may use parametric insurance to cover penalties when heavy rainfall delays a construction project.

Cover for Economic Losses that are not Linked to Direct Damage

Example: A hotel may get paid if tourism drops after a cyclone, even if the property itself is not damaged.

Cover for Costs that are Excluded or Limited Under Normal Policies

Example: This can include extra costs like debris removal, blocked access to buildings, landscaping repairs, urgent construction work, or higher prices due to worker or material shortages.

Events Where Fast Cash is Needed for Recovery

Example: Local councils or government agencies may need quick funds after a disaster to provide shelter, food, water, medicine, or fuel to the community.

What to Consider When Designing Parametric Insurance?

Parametric insurance is built to meet each customer’s individual exposure, risk appetite, budget and legal environment. This means no two policies are exactly the same. Still, there are some common factors to think about when designing parametric insurance.

Parameter

Most policies use natural disaster measures like wind speed or earthquake strength. But triggers can also include parameters like power cuts, booking cancellations, or drops in yearly revenue.

Susceptibility

It is important to see how much the chosen parameter could affect the client. If the event happens, what level of loss would the client be likely to suffer?

Asset Distribution

When you are designing parametric insurance, decide what needs to be covered and where? For example, a business may want coverage for coastal warehouses exposed to hurricanes, but not for inland offices with lower risk. By clearly mapping out what to cover and where, the policy becomes more effective.

Insurance Structure

Always consider how to structure the solution so that there is a good correlation between the index and sustained financial loss linked to risk appetite and budget considerations

Data Source

To design a solution, objective, independent and consistent data is needed to establish the index. This is usually provided by a third party, such as a national weather service, or specialist firms.

Data Modelling

Analysis of historical data and possible future events allows us to simulate potential scenarios and refine the insurance structure.

Solution

The most important factor to consider when creating a parametric insurance solution is how it will reduce the identified risk, mainly by defining how payouts will work once the trigger is met.

What Different Types of Parametric Insurance Solutions Exist?

Parametric insurance helps manage different kinds of risks. It also offers quick payouts when a trigger is reached. Let’s discuss some examples of parametric insurance and find out how these solutions work in real situations.

Parametric Hurricane Insurance

Hurricanes are becoming stronger and less predictable. This creates serious problems for property owners in high-risk areas. Florida is one of the most exposed regions to extreme hurricanes. Parametric hurricane insurance is designed to help people in risk-prone areas. It pays out based on set triggers like storm category or wind speed. This means payouts are made quickly, without long inspections. Property owners can use the money right away to handle urgent financial needs and damages.

Parametric Flood Insurance

Flooding is the most common natural disaster. It causes huge damage to homes, businesses, and infrastructure. It also disrupts daily operations. Parametric flood insurance provides a clear and simple solution. Payments are based on fixed triggers, such as water levels or rainfall amounts. Businesses in flood-prone zones benefit the most. They get money fast, without waiting for slow and detailed damage checks.

Parametric Crop Insurance

Farmers are at the front line to face the atrocities of weather and climate change. Parametric crop insurance protects them using data-driven triggers. These triggers may include rainfall amounts or temperature changes. If the trigger is met, the payout is made. This gives farmers timely support when their crops are at risk.

Parametric Freeze Insurance

Cold weather can ruin crops before they mature. This leads to sudden income losses. Parametric freeze insurance helps by using temperature triggers. If the temperature falls below the set level, the policy pays out. Farmers and businesses can use the funds to recover quickly.

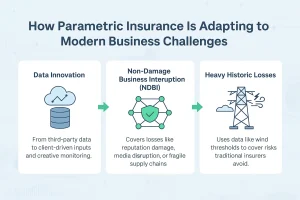

How Parametric Insurance Is Adapting to Modern Business Challenges

As data becomes more advanced and widely available, new ways of gauging risk are opening up. Traditionally, data usually come from an independent third party. Now, insurers are also beginning to use data from clients themselves. This is creating more flexible ways to set triggers and indexes. Monitoring methods are also becoming more creative. For example, phone signal data can show how busy a shopping mall is. Because of these innovations, several new areas of coverage are emerging.

Non-Damage Business Interruption (NDBI)

Businesses are now more exposed to losses that do not come from physical damage. Intangible assets are becoming a major part of company value. Supply chains are longer and more fragile. Issues like reputation damage, media disruptions, or infrastructure breakdowns are creating risks. Parametric insurance can help fill this gap by offering protection against these non-damage interruptions.

Heavy Historic Losses

Some risks are so frequent that traditional insurers refuse to cover them. For example, repeated damage to transmission and distribution (T&D) lines has made it hard for companies to find coverage. By using data, such as wind speed thresholds and recurrence patterns, parametric insurance can make these risks insurable again.

Watch this Video to Learn More about Parametric Insurance

FAQs about Parametric Insurance Coverage

What Is Parametric Insurance?

Parametric insurance is an index-based insurance policy when a specific event meets a pre-set trigger. Instead of waiting for an inspection to measure actual damage, the payout is made automatically once the event is confirmed by trusted data. For example, if wind speeds go over an agreed-upon level, you get a payout. You also get a payout if rainfall crosses a certain threshold. The policyholder receives the money without any delays.

How Does Parametric Insurance Work?

The process begins with choosing a clear trigger like wind speed, rainfall, or earthquake magnitude. Both parties agree on how it will be measured. Next, the payout structure is set. This lets both sides know the exact payment if the event happens. Independent data sources like weather agencies or satellites monitor the event. If the trigger is met, the agreed sum is paid quickly.

Who Offers Parametric Insurance?

Parametric insurance is offered by large global insurers and reinsurers, specialist insurtech firms, and regional risk pools. For example, companies like Swiss Re and Munich Re have parametric solutions. Organizations like CCRIF SPC provide disaster coverage for countries in areas with frequent hurricanes. New digital platforms and agricultural insurers are also expanding these products especially for farmers and small businesses.

How Much Does Parametric Insurance Cost?

The cost of this insurance depends on several factors. These factors include the type of risk, the payout amount, and how likely the trigger event happens. Broader coverage or higher payouts usually mean higher premiums. In some pilot programs, premiums have been as low as a few dollars per month for homeowners. However, large commercial policies can cost a lot more depending on the risk.

What Is a Parametric Insurance Product?

A parametric insurance product is a policy built around a clear trigger and a fixed payout. It defines the event, the threshold, and the amount to be paid. All of this is confirmed by independent data. For example, a product might pay $100,000 if rainfall in a region exceeds 200 mm in a month. Because the payout is not tied to actual damage, it is fast, transparent, and easy to understand.