If you’ve spent years building a strong financial foundation, you’ve probably asked yourself a quiet question at some point: How do I protect this—not just for my kids, but for my spouse too—without handing half of it to taxes later?

That question matters now more than ever. In 2025, the federal estate and gift tax exemption is sitting at $13.99 million per person, almost $28 million for a married couple. But that number isn’t carved in stone. It’s expected to shrink in 2026, and if your assets grow past that reduced threshold, your estate could face a hefty tax bill when the time comes.

That’s why some couples are turning to a planning tool called a Spousal Lifetime Access Trust, or SLAT. On the surface, it might sound like legal overkill. But at its core, a SLAT is about balance. One spouse moves assets into a trust that supports the other—helping reduce estate tax exposure while still keeping some financial flexibility alive.

It’s not just a tax tactic. It’s a strategy that says: We want to take care of each other now—and still leave something meaningful behind.

Of course, SLATs come with rules, trade-offs, and a few big “what ifs” you have to plan around. That’s what this guide is for. We’ll walk through what a SLAT is, how it works, what could go wrong, and why—when done right—it can give your family clarity, confidence, and control across generations.

Read More: Interest-Free Hardship Loans in NY: Financial Relief Without Extra Cost

So, How Does a SLAT Actually Work?

Let’s discuss it step by step—because yes, a Spousal Lifetime Access Trust (or SLAT) might sound like something you need a law degree to understand. But once you strip away the legal buzzwords, it’s honestly not that intimidating.

It starts with one spouse—often the one managing more of the financial side—choosing to move some assets out of their own name and into a trust. This isn’t done casually. They’re using part of their lifetime gift tax exemption to make that move official. In simpler terms, they’re saying, “Let’s protect this piece of our wealth by shifting it somewhere the IRS can’t count it later.”

And that “somewhere” is a trust built for the benefit of the other spouse.

The spouse on the receiving end—called the beneficiary—gets access to income from the trust, and depending on how the trust is set up, maybe even the principal too. You can also add your kids or grandkids as future beneficiaries, either right away or after the spouse passes. The whole thing can be customized to fit your family’s picture.

Here’s where the magic happens: even though your spouse can still benefit from what’s inside the trust, those assets are no longer part of either of your taxable estates. That’s a huge win when you’re thinking about long-term wealth protection.

Want to go a step further? If the grantor spouse applies their generation-skipping transfer (GST) tax exemption, this trust can keep benefiting your family for decades—possibly well beyond your grandkids. No estate tax. No GST tax. Just clean, protected transfers, generation after generation. It’s one of the few ways to do real multigenerational planning without leaving a mess behind.

What If Life Doesn’t Go as Planned?

Now let’s talk about something not-so-fun, but very real. The grantor—the one who created the SLAT—can’t tap into the trust directly. Their only link is through the spouse they created the trust for.

So, what happens if that spouse passes away?

That connection? It disappears. Same story if the couple divorces. The grantor no longer has any path back to those funds, even if they were benefiting from them indirectly before. And if the trust wasn’t written carefully, they might even end up supporting someone they’re no longer married to. That’s a situation no one wants to fall into.

This is why careful planning is everything. It’s not just about following the rules—it’s about thinking through every possible curveball.

What Can You Actually Put in a SLAT?

Just about anything with value. Investment portfolios, life insurance, real estate, business interests—they’re all fair game.

Let’s say you’re thinking of adding a rental property or vacation home. You wouldn’t just drop it directly into the trust. Usually, it’s moved into an LLC first, and then the trust holds shares in that LLC. It’s a cleaner structure and helps with management down the line.

And if you’re gifting part of a closely held business? That can work too—but you might need to tweak the setup. Often, people keep the voting shares (so they still run the show) and gift the non-voting shares to the trust. That way, you get the estate planning benefits without losing control of your business.

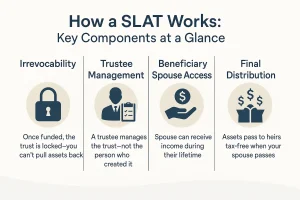

Key Components and Characteristics of a SLAT

Let’s break down what actually makes a Spousal Lifetime Access Trust (SLAT) tick. It’s not just a fancy legal term—it’s a financial strategy built with some pretty smart mechanics.

Irrevocability

Here’s the first thing to understand: a SLAT isn’t something you can hit “undo” on. Once it’s set up, that’s it. The money or assets you put into it are no longer yours—they belong to the trust. You can’t yank them back later if you change your mind.

And weirdly enough, that’s the beauty of it. This “no backsies” rule is actually what removes the assets from your estate for tax purposes. If you could just take them back anytime, the IRS would never let you claim the tax benefit in the first place.

Trustee Management

Once the SLAT is up and running, someone needs to manage what’s inside. That’s the trustee’s job.

Sometimes, the trustee is your spouse (the one benefiting from the trust). Other times, it’s a third party—like a trusted relative, friend, or even a professional fiduciary. They’re in charge of making sure the money or assets in the trust are handled responsibly and according to the rules you laid out when the SLAT was created.

So no, the donor spouse (that’s you, if you’re the one setting it up) doesn’t call the shots anymore. That’s part of the deal.

Beneficiary spouse

Now here’s where it gets interesting: your spouse—the beneficiary—can still access funds from the trust while they’re alive. Typically, they receive income that’s generated from the trust’s investments.

Think of it as a safety valve. You’ve removed the assets from your taxable estate (which is good for long-term planning), but your family still has a pipeline of support if needed. Meanwhile, the principal stays protected—and out of estate tax territory.

Distribution to beneficiaries

When your spouse eventually passes away, what’s left in the trust goes to the next in line—usually your kids, though you can name whomever you like (just not yourself).

And here’s the big win: those remaining assets get passed on without getting hit by estate taxes. That’s one of the biggest reasons people set up a SLAT in the first place. It’s a way to support your spouse now and pass on wealth later, all while trimming down the tax bill.

How a SLAT Can Help You Cut Down Estate Taxes

Let’s talk about what really draws people to a SLAT—its ability to shrink your estate tax bill. If you’re sitting on significant assets and thinking long-term, a SLAT can be a sharp move for two main reasons.

Exclusion from Taxable Estates

Once you transfer assets into a SLAT, they’re no longer part of your taxable estate—or your spouse’s. That means any growth those assets see over time? It’s off the radar for estate taxes. You’re locking in the current value and shielding everything it earns in the future from Uncle Sam’s reach.

Here’s how that plays out in real life:

Let’s say it’s 2024. Arthur decides to set up a SLAT, naming his wife Betty as the beneficiary. He transfers ownership of a valuable piece of farmland into the trust. That land keeps doing what land does—it earns income. Betty, as the beneficiary, gets that income paid out to her. She doesn’t keep it all to herself, either—she deposits it into the joint account she shares with Arthur. So yes, he still gets to benefit from that income, just not directly from the trust.

When Betty eventually passes away, the land in the trust goes straight to their heirs—estate tax free. The IRS doesn’t touch it because it’s been outside of both Arthur and Betty’s estates the entire time.

Pretty clever, right?

Pre-exemption Reduction Transfers.

Here’s something else people don’t always realize: the current estate tax exemption is the highest it’s ever been—but it’s set to drop in 2026. Right now, each person can pass on nearly $13 million without triggering estate taxes. But unless Congress acts, that exemption will be cut in half.

So what happens if you move a large chunk of assets into a SLAT today—say, something worth more than the future lower exemption?

Good news: it’s not pulled back into your estate later. The IRS won’t say, “Hey, that farmland is now worth more than what’s allowed in 2026, so we’re going to tax it.” Nope. That transfer is locked in at today’s rules.

This little strategy is especially valuable if your wealth already exceeds where the exemption is headed. It’s a way to freeze the clock while the exemption is still generous.

The Pros and Cons of Using a SLAT in Your Estate Plan

Like most estate planning tools, a Spousal Lifetime Access Trust (SLAT) isn’t a one-size-fits-all move. It comes with real benefits—but also a few trade-offs you’ll want to think through before diving in. Let’s break it down.

The Upside

- Exclusion from estate: One of the biggest wins? The assets you put into a SLAT are removed from both your estate and your spouse’s. That means if those assets grow over time—which, ideally, they do—the IRS doesn’t get a slice of that future appreciation when it’s time to settle the estate. It’s not just about what you give today. It’s about protecting tomorrow’s growth, too.

- Lifetime benefits: Just because you’ve moved the assets out of your estate doesn’t mean your spouse is cut off. Far from it. The trust can generate income and, in some cases, even allow for distributions of principal—if the trustee signs off. So your spouse gets continued financial support during their lifetime, and the trust remains in motion quietly in the background.

- Asset protection: Because the SLAT is irrevocable, it also adds a layer of legal protection. Creditors can’t just reach in and grab what’s inside the trust—not yours, and not your spouse’s. It’s not bulletproof, but it’s a strong shield if you’re trying to safeguard wealth from potential claims down the road.

The Downsides

- Irrevocable nature: This is a big one. Once the assets are in the SLAT, you can’t call an audible and reverse the play. You’ve given up ownership and control. For some people, that’s fine—it’s part of a long-term plan. But if you like to keep your options open, this might feel a little too final.

- Dependency on spousal relationship: A SLAT depends heavily on your relationship staying steady. If divorce enters the picture, your ability to access the trust—albeit indirectly through your spouse—could evaporate. Same goes for the unexpected loss of your spouse. Either way, the “lifetime access” piece of the SLAT becomes less meaningful if your spouse is no longer in the picture.

- No Step-Up in Basis for Heirs: Here’s something people often miss: assets passed on through a SLAT don’t come with a stepped-up cost basis. That’s tax-speak for saying your heirs may have to pay capital gains taxes on the full appreciation of the assets since the day you first acquired them. By contrast, if they inherited those assets through your will or a revocable trust, they’d likely only pay taxes on gains made after your death. So, depending on the asset, this could mean a much bigger tax bill down the line.

The Reciprocal Trust Trap: What to Watch Out For

Now, here’s where things can get a little tricky. A lot of couples think, “Hey, if one SLAT is good, wouldn’t two be even better?” And on paper, it makes sense—each spouse sets one up for the other, doubling the potential tax savings.

But the IRS has seen this move before, and they’re not impressed. If those two trusts look too much alike—same structure, same timing, same setup—the IRS can hit you with something called the reciprocal trust doctrine. And once that gets triggered, all the tax savings you were counting on? Gone. The assets can get pulled right back into your estates for tax purposes.

So how do you avoid that mess?

The key is to make sure the two SLATs aren’t mirror images of each other. They need to look, feel, and function differently. That can mean:

- Setting them up at different times, even just a few months apart

- Appointing different trustees, or adding different successor trustees

- Choosing different distribution rules—maybe one allows for principal distributions and the other doesn’t, or one includes different beneficiaries down the line

The goal is to make it clear that each trust stands on its own. That way, you can enjoy the benefits of both without getting caught in a legal tangle.

Avoiding Common SLAT Mistakes: What to Know Before You Set Things in Stone

A Spousal Lifetime Access Trust can be a great way to protect family wealth—but only if it’s built with care and a clear head. This isn’t something you just throw together and hope for the best. A SLAT needs to fit your life, your goals, and your relationships.

Let’s go through a few real-world issues that can cause trouble if overlooked. Catching these early can save you and your loved ones a lot of stress—and possibly a big tax bill—down the road.

Divorce or Losing a Spouse Changes Everything

Since your spouse is the one who benefits from the trust during their lifetime, the whole setup depends on that relationship. If the two of you divorce, or if your spouse passes away, your indirect access to those trust funds vanishes.

That’s a hard stop. No workaround. From that point on, the assets stay in the trust, but you—meaning the grantor—can’t touch them anymore. So if you’re even considering a SLAT, the long-term stability of the marriage has to be part of the conversation.

Be Thoughtful About Who You Name as Trustee

Yes, your spouse can serve as the trustee of the SLAT. But just because you can, doesn’t mean you always should.

If your spouse is both trustee and beneficiary and starts distributing trust money to themselves for reasons that go beyond basic needs—like support, education, or health—it could backfire. The IRS might say, “That looks like too much control,” and include the trust’s assets in their estate.

That’s where having a neutral co-trustee helps. Someone who’s not a family member, not a beneficiary, and can help make decisions with a clear head. It’s just an extra layer of protection.

Don’t Overlook Gift Tax Implications

Funding a SLAT is considered a gift—and a big one, depending on what you’re putting in. That means you’re using part of your lifetime gift and estate tax exemption. Go too far, and you could run into tax liability. Even if you’re within your limit, you might still need to file a gift tax return—Form 709—to keep things clean with the IRS.

The takeaway? Don’t move large assets into a SLAT without talking it over with a qualified tax pro. Guesswork isn’t your friend here.

Cloning Trusts Could Cost You Big

A lot of couples get this idea: “Let’s each create a SLAT for the other and double the benefit.” It sounds great—but if the two trusts are too similar, the IRS might step in and say they cancel each other out. That’s called the reciprocal trust doctrine, and it can undo the entire tax-saving purpose of the SLAT.

The fix? Make sure each trust has a different flavor. That might mean:

- Using different funding sources

- Naming different people to benefit later

- Signing the trusts at different times

- Choosing different trustees or powers

As long as it’s clear these are two distinct setups—not a matched pair—you should be okay.

Choose the Right Assets to Fund the SLAT

Not every asset is the right fit for a SLAT. Ideally, you’re using something that’s likely to grow over time—because all of that growth will happen outside your estate, which is the goal.

One catch: if you and your spouse own an asset jointly, you can’t just move it into the SLAT. That’s especially tricky in community property states, where most things are assumed to be jointly owned. You may need to split ownership first or restructure things—possibly through an LLC—before transferring to the trust.

It adds some steps, but they’re worth it. Getting it right from the start avoids headaches later.

Final Thoughts: Is a SLAT Right for You?

At the end of the day, a Spousal Lifetime Access Trust is one of those estate planning tools that can be incredibly smart—if it fits your specific financial picture. It works especially well for families with assets that are likely to grow significantly over time, or for those looking to lock in today’s higher estate tax exemption before 2026 rolls around.

But this isn’t a DIY project. Setting up a SLAT means making permanent decisions that can affect not only your wealth, but your family’s future access to it. You’ll want to work closely with a seasoned estate planning attorney and a tax advisor who understands the ins and outs of SLATs, especially when it comes to staying clear of reciprocal trust issues.

In the right situation, a SLAT can give you a rare win: reduce your estate tax burden while still keeping your loved ones supported. But like any powerful tool, it only works well in skilled hands—with a clear plan behind it.

FAQs

1. What Is a SLAT, Really?

A Spousal Lifetime Access Trust, or SLAT, is one of those estate planning tools that feels like it’s walking a fine line: it helps you move wealth out of your estate for tax purposes—but still leaves the door open to support your spouse if needed.

Here’s how it works at its core: One spouse—the donor—creates an irrevocable trust and transfers assets into it. The other spouse becomes the beneficiary, which means they can receive distributions from the trust while they’re alive. Those assets are no longer part of the donor’s taxable estate, but if life happens and funds are needed, the beneficiary spouse can draw from the trust.

Most SLATs are designed to end when the beneficiary spouse passes away. At that point, whatever’s left in the trust typically passes on to the next generation—children, grandchildren, or whomever you’ve named.

It’s a way of offering support now while building in protection and tax savings for the future.

2. What Do You Need to Set Up a SLAT?

This isn’t something you can throw together on a whim—there are a few important conditions you’ll need to meet upfront.

- Only separate property can be used. If you live in a community property state (like California, Texas, or Arizona), you’ll likely need to legally convert jointly owned assets into separate property before funding the trust.

- You can’t keep control. Once those assets are in the SLAT, the donor spouse can’t touch them again or retain any rights. That’s the trade-off for getting them out of your estate.

- No cloning allowed. If both spouses decide to create SLATs for each other, the trusts need to be clearly different. If they mirror each other too closely, the IRS might step in and apply what’s known as the reciprocal trust doctrine—which could bring all those assets back into the taxable estate.

- It has to be irrevocable. Meaning once it’s created, it can’t be undone. That’s part of what makes the tax savings stick.

3. Why People Choose a SLAT

A SLAT can be an appealing choice for a few smart reasons:

- It provides a safety net. If your spouse ever needs financial support, the trust can help cover those needs—even though the assets are technically out of your estate.

- It captures future growth. Any increase in value of the assets inside the SLAT won’t be counted toward your estate later. That means more of your hard-earned wealth can go directly to your beneficiaries.

- It grows tax-free. Even though the trust is separate, you—the donor—are still responsible for paying the income taxes on any income the SLAT generates. That might sound like a burden, but it’s actually a benefit. Paying those taxes out of your own pocket means the trust can grow untouched, maximizing what your heirs eventually receive.

- It offers some legal protection. When set up properly, SLAT assets are often shielded from creditors who might come after either you or your spouse.

- It’s versatile. You can even fund it with things like life insurance, or real estate—depending on your goals and how you structure it.

4. Is a SLAT the Right Move for You?

A SLAT isn’t just a clever estate planning technique—it’s a deeply personal choice. It works best for people who want to move assets out of their estate while still keeping a safety valve open, just in case.

If you’re ready to take advantage of the current (and historically high) estate tax exemption but aren’t quite ready to let go of access completely, a SLAT might offer the flexibility you need.

Just be sure you’re walking into it with eyes open. Understand the legal requirements. Know what you’re giving up. And always work with a qualified estate attorney and tax advisor who can tailor the plan to your specific situation. In the end, a SLAT isn’t about complexity—it’s about clarity. And when used wisely, it can offer both peace of mind today and security for the people you care about tomorrow.