There are many health insurance plans available in the market, but choosing the one that truly fits your needs can feel like a challenge. Out of all those available health insurance plans, two are: High deductible Health plans and Preferred provider organization. In this blog, we’ll make the HDHP vs PPO comparison simple and clear.

You’ll discover the strengths and drawbacks of each option, see real-life examples of who should pick what, and learn when each plan makes the most sense. By the end, you’ll know exactly whether to lean toward lower monthly costs with an HDHP + HSA, or predictable coverage and flexibility with a PPO.

TL;DR: HDHP vs PPO

An HDHP combined with an HSA is often the smarter choice if you are young, healthy, and do not expect much medical care. Your monthly premiums will be lower. The money you save can go into your HSA and grow tax-free. You can use it later for medical costs.

A PPO usually provides more value if you have frequent doctor visits, a chronic condition and need brand-name medications. In this case, you will likely reach the deductible limit faster and benefit from cost-sharing.

What is a High Deductible Health Plan (HDHP)?

A High Deductible Health Plan (HDHP) is a type of health insurance plan that requires you to pay a larger amount out of pocket before your insurance begins to share the costs. It’s designed to protect you from very large or unexpected medical bills, like hospital stays, surgeries, or expensive treatments.

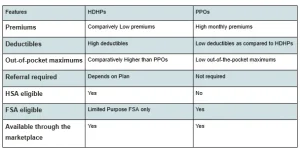

Before understanding a high deductible health plan, you have to understand a few terms like premium, deductible, cost-sharing, and out-of-pocket.

Premium is the monthly amount that you have to deposit once you sign up for your plan. This is your monthly subscription fee to keep the insurance active. For example, if your premium for the plan is $300 per month. You have to pay $300 each month, irrespective of whether you visited the doctor or not.

The next term is deductible. It is the upfront fee that you have to pay before you qualify for cost-sharing. For example, your upfront or deductible is $2000. Your plan won’t pay you a penny until you reach this limit. Suppose you visit your doctor and your medical bill crosses $2000. Now you have crossed your deductible limit. From now on, you won’t have to pay your medical bill fully for this year.

As your medical fee for the year has already reached $2000, now your insurer will share your bills with you. It can be done in two ways: copay or coinsurance. In a copay, you pay a fixed amount of your bill. Let’s say you have to pay $30 for your bill. The rest will be paid by your plan. Even if the bill is $150 or $1500, you will only have to pay $30. In coinsurance, you have to pay a fixed percentage of your bill. Suppose the bill is $1500. You will have to pay 30%. That is $450. And if your bill is $2000, you will have to pay $600 of your bill.

Now, in the same year, if your medical bill further increases and reaches $8000 altogether, that is your out-of-pocket maximum. When you reach this limit, your insurer will pay all your in-network medical bills till the end of the year.

One more thing that is important for you to understand is the difference between in-network and out-of-network services. In-network services include doctors and hospitals that are part of your plan’s approved panel. Out-of-network services include doctors or providers that are not covered under that panel. In-network deductibles are usually lower and more beneficial, while out-of-network.

What is a Preferred Provider Organization (PPO)

A Preferred Provider Organization (PPO) is a type of health insurance plan that gives you more flexibility and choice compared to other plans. A PPO uses a large managed-care network that includes doctors, specialists, hospitals, and clinics. All these providers have contracts with the insurer. These providers agree to offer services at lower, negotiated rates. Because of this, you usually pay less when you stay in-network. Unlike many other plans, PPOs do not require you to choose a primary care doctor. You also do not need a referral to see a specialist. You have the option to go out of the network. However, this choice almost always costs more money.

Like all insurance plans, PPOs have associated costs you must understand. The premium is the monthly fee you pay to keep your coverage active. PPO premiums are usually higher than other plan types.

The deductible is the amount you must pay yourself before your insurance begins helping with the bills. PPOs might have two separate deductibles. One is a lower amount that is for in-network providers. The second is a larger amount for out-of-network providers. After you meet the deductible, you share costs through copays or coinsurance. Copays are fixed amounts per visit, like $30. Coinsurance is a percentage, such as 30% of the bill.

Once your medical bills reach the out-of-pocket maximum limit, your plan pays 100% of covered services. This coverage lasts for the rest of the year. PPOs still cover out-of-network care. However, this care comes with higher deductibles and higher coinsurance. It may also include “balance billing.” Balance billing occurs when the provider charges you more than the insurer allows.

Pros and Cons of a High Deductible Health Plan (HDHP)

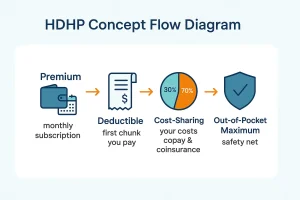

Pros

The biggest benefit is that you can pair it with a Health Savings Account (HSA). An HSA lets you put money tax-free into your account. It allows that money to grow tax-free, you can use it tax-free for medical costs, and if you do not spend the money this year, it rolls over to the next year. This helps you build a cushion for future health expenses.

Another advantage is lower monthly premiums. You pay less each month compared to most other plans. Additionally, many employers deposit money into your HSA as a part of the contract you signed at the time of appointment. This reduces your real costs even more.

Cons

HDHPs have higher deductibles. This means you pay a large amount of money yourself before the plan starts helping. You also face more financial risk if you suddenly get sick or injured. In this case, you must cover thousands of dollars before your insurance starts paying. HDHPs have comparatively higher deductibles and out-of-the-pocket maximum limits for out-of-network doctors.

Pros and Cons of a Preferred Provider Organization (PPO) Plan

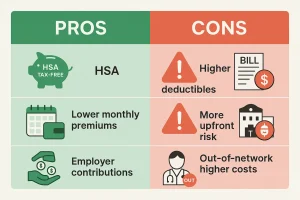

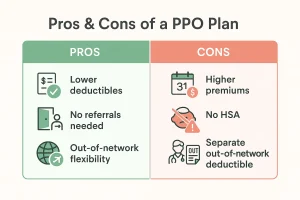

Pros

A PPO makes more sense for you if you need regular care and want the freedom to see specialists without extra steps. One advantage is the lower deductible compared to HDHPs. This means the plan starts helping you sooner. You also do not need referrals to see specialists. You can book an appointment directly. PPOs also cover out-of-network care. This gives you more flexibility if you are traveling. It also helps if you want to see a doctor outside your plan’s main network.

Cons

PPOs usually have higher monthly premiums. This means you pay more every month regardless of whether you use care or not. You also do not get access to an HSA. Some employers may offer an FSA instead, but an FSA has stricter rules. In the case of FSA, unused money often does not roll over. Another drawback is that PPOs often have a separate, higher deductible for out-of-network care. Therefore, you will likely pay more out of pocket if you go outside the network.

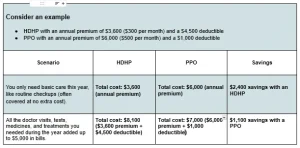

Total Cost of Care: Which Really Saves You More?

To find the total cost of your plan, you have to add up your premiums (premium x 12), cost before deductibles and cost after deductibles till the out-of-pocket maximum limit. If you are getting any help from your employer or HSA, deduct it from your total amount.

Suppose your monthly premium is $300, and the cost before deductible is $4000. After the deductible, you have to copay $50 until you reach your out-of-pocket limit, which is $12000. Your plan will cost you $15600. If you are receiving any help from your employer, you can deduct it from the total cost.

Expected annual cost = (12 × 300) + 4,000 + 8000 = $15600

In a low-use year where you don’t visit many doctors or have big medical bills, a high deductible health plan (HDHP) often costs less overall. Because the monthly premium is lower, and you can use your HSA contributions to cover those early costs, which lowers your real outlay.

In a high-use year when you need lots of care, tests, or specialists, a PPO plan might cost you less, in total. This is because PPOs often have lower deductibles, more generous cost-sharing. Moreover, it allows more providers in the network.

Who Should Pick What?

The right plan depends on your health needs and how much financial risk you are comfortable with. Both HDHPs and PPOs can work well. However, in different situations, one plan often makes more sense than the other.

Based on the above example, we can conclude that:

An HDHP combined with an HSA is often the smarter choice if you are young, healthy, and do not expect much medical care. Your monthly premiums will be lower. The money you save can go into your HSA and grow tax-free. You can use it later for medical costs.

A PPO usually provides more value if you have frequent doctor visits. Even though the premiums are higher, the deductible is lower. This means the plan starts paying sooner. That can reduce the impact of repeated copays, labs, and prescriptions throughout the year.

People managing a chronic condition and needing brand-name medications often find PPOs more predictable. You will likely reach the deductible limit faster and benefit from cost-sharing.

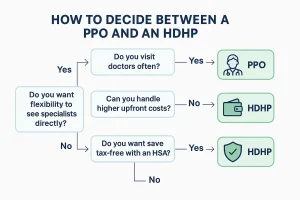

How to Decide Between an HDHP and a PPO

- Healthcare needs: Start by considering your own health. Think about how often you visit doctors. An HDHP may be enough if you usually only need routine checkups and basic care. A PPO might save you more in the long run. This is true if you or your family see doctors often. It is also true if you need regular specialist visits.

- Financial comfort: Think about how much you can pay upfront. An HDHP has lower monthly premiums. It also has higher deductibles. This means you will pay more out of pocket before your plan starts helping. A PPO costs more each month. However, it lessens the impact when unexpected medical bills appear.

- Flexibility: With a PPO, you can see specialists directly. You do not need referrals. You also usually get access to a wider network of doctors. An HDHP may have stricter rules. However, it pairs with an HSA. The HSA can grow your savings tax-free.

- Network size: Ask yourself how important a large choice of providers is. PPOs generally offer bigger networks. This is the case if you travel or want maximum flexibility.

At the end of the day, both plans can save you money. They save you money in different ways. An HDHP can keep monthly costs low. It can also help you build savings. This is true if you rarely use healthcare. A PPO gives you predictability and easier access to doctors. This is true if you need frequent care.

How to Compare and Switch Today

You can only change your health plan at certain times. The first time is during Open Enrollment. This happens once every year. The second time is after a major life change. Examples are getting married, getting divorced, having a baby, or losing other insurance. You usually cannot switch outside of these times.

Get your information ready before you switch. List all your current medications. List your favorite doctors or specialists. Write down the most you can spend on health care each month. These facts make it simpler to compare plans. You can see which plan; HDHP or PPO; best fits your needs and budget.

You have three main ways to shop for a plan. If you get insurance through work, start with your employer’s website. If you buy your own plan, go to HealthCare.gov during Open Enrollment. You can also check your state’s marketplace. You can also look at private insurance companies directly.

Check your needs and look at the costs. This will show you the best choice before you switch. You will know if you should pick lower monthly payments (HDHP) or better coverage and less risk (PPO).

Watch this Video if You are Curious to Learn More About HDPHs vs PPO

FAQs about High Deductible Health Plan vs PPO

What is HDHP vs PPO?

An HDHP has lower monthly premiums. It has higher deductibles. This means you pay more up front. You pay before the plan starts helping. A PPO has higher premiums. It has lower deductibles. A PPO also lets you see specialists without referrals. It often covers more doctors.

PPO vs HDHP — which is better?

Neither plan is “better” for everyone. An HDHP often makes sense if you are young and healthy. It is good if you want to save money with an HSA. A PPO may save you more overall. This is true if you need frequent care or brand-name prescriptions. It is also true if you value flexibility with providers.

When to choose HDHP vs PPO?

Choose an HDHP if you rarely visit doctors. Choose it if you want lower monthly costs. Pick it if you like the tax benefits of an HSA. Pick a PPO if you expect lots of care. Choose it if you want predictable costs. Select it if you prefer easy access to specialists and a bigger network.

Are HDHPs bad if I take several prescriptions?

HDHPs can become costly. This happens if you need multiple brand-name drugs. It is also true if you need frequent refills. You must pay the full price until you reach the deductible. Therefore, a PPO is often safer for managing regular prescriptions.

Can I switch between HDHP and PPO mid-year?

Usually, no, you cannot switch mid-year. You can only switch during Open Enrollment. You can also switch if you have a qualifying life event. Examples include marriage, having a baby, or losing other coverage. Otherwise, you must wait until the next enrollment period.