NAV lending is when a private equity fund borrows money. The loan is backed by the value of its entire portfolio. It gives fund managers quick access to cash. They don’t have to sell their best assets when prices are low. It’s like unlocking the value of what you already own. You still get to keep those assets in your hands.

Why NAV Lending Is Gaining Traction

It’s no secret that the private equity world is going through a big shift. For years, the industry enjoyed high returns. Deals closed quickly. Investors were eager to commit money. But today, the picture looks different. Capital is harder to move. Exit opportunities have narrowed. The steady flow of cash distributions has slowed down more than many expected.

Since 2019, global private equity assets under management have almost doubled. They have grown to around $10 trillion. This kind of growth brings pressure. That pressure is even stronger with rising interest rates, inflation shocks, and fewer IPOs and M&A deals. Fund managers hold valuable assets. But turning those assets into cash without hurting long-term value has become a real challenge.

This is where NAV lending has stepped in.

When traditional ways of getting liquidity slow down, NAV loans fill the gap. Fund managers borrow against the net asset value of their portfolio. This gives them capital without selling at a bad price. They also keep control of their assets. It’s a practical option. It’s non-dilutive. And it works well in a market with limited flexibility.

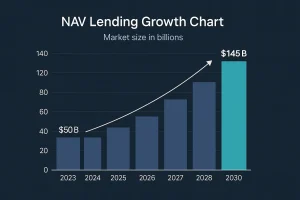

Investors have noticed. The NAV lending market was valued at around $50 billion in 2023. By 2030, it’s expected to reach $145 billion. This kind of growth doesn’t happen by chance. It happens when a financial tool moves from being niche to becoming a necessity.

Key Players and Institutional Interest

As NAV lending grows, some of the biggest names in the industry are stepping forward. They are not just using it. They are openly supporting it.

Take Blackstone, for example. They have publicly shared their confidence in NAV lending. They see it as a major opportunity in asset-backed finance. In recent investor calls, their leaders described NAV solutions as a high-potential area. They are actively exploring and investing in it. Silicon Valley Bank (SVB) has shown the same optimism. They note that NAV loans are becoming more common in the U.S., especially when exit markets slow down.

This interest is not just talk. Institutional capital is following the trend. Insurance companies, asset managers, and private credit funds are getting more involved. Some have even built dedicated NAV lending divisions. They see it as a way to offer strong, risk-adjusted returns with portfolio-level diversification.

What’s pulling them in? A few key things. One is that the downside risk is relatively low. NAV loans are often backed by a diversified set of assets. They also carry low loan-to-value ratios. Another is that lenders usually don’t take ownership. This makes the transaction risk more manageable. The deals are well-structured. The portfolios are seasoned. The terms are often more favorable than traditional debt arrangements.

For these institutions, NAV lending offers something rare in today’s market. It blends stability, opportunity, and strategic timing. It helps them support private equity growth without taking on too much risk. It also positions them as important liquidity partners in a space where trust and timing matter most.

As more funds see the benefits — and more capital becomes available — NAV lending is moving from niche to mainstream. It is quickly becoming a core part of modern fund management.

Benefits of NAV Loans for Lenders

NAV loans are not just for fund managers who need liquidity. They also offer real advantages to the lenders providing them. In a market where traditional lending can feel too rigid or too risky, NAV loans strike a balance. They offer steady returns, built-in protection, and exposure to strong private equity portfolios.

Strong Risk-Adjusted Returns

For lenders, the quality of returns is a big draw. Traditional direct lending often depends on one company’s success. NAV lending is different. It’s backed by the combined value of a full portfolio. That diversification reduces volatility and keeps yields competitive.

NAV loans usually sit as senior debt. This means lenders are near the front of the repayment line. When a fund sells a company or makes distributions, the NAV lender is often paid before investors. This priority reduces repayment risk and shortens timelines.

In short, lenders get access to private market returns without taking on all the private market risk. The result is stable, predictable income backed by proven portfolios.

Downside Protection

No loan is risk-free, but NAV loans are built with protection in mind. They are senior obligations, so the lender’s claim comes before most others. Even if part of the portfolio underperforms, the loan is supported by the entire fund’s value.

History shows their resilience. In 2008, private equity portfolios dropped about 25%, while public markets fell around 45%. Over decades, deep losses have been rare in well-managed funds.

The cross-collateralized structure adds another layer of safety. If one company struggles, others can help cover repayment. Lenders are backing the portfolio as a whole, not betting on one outcome.

Flexible Use and Strong Alignment

NAV loans also give lenders a role in supporting a fund’s growth. They are often used for strategic moves, not quick fixes.

Funds might use them to make acquisitions, refinance debt, or replace expiring credit lines. They can also return capital to investors sooner, boosting IRR and aiding future fundraising.

This flexibility means lenders support both growth and stability. Many NAV loans go to mature funds with proven strategies. In these cases, the GP is seeking capital to maximize outcomes — exactly the kind of partner most lenders want.

Risk Factors and Considerations

NAV lending offers big opportunities for both fund managers and investors. But like any financial move, it carries risks. The setup may look simple, yet it has many layers. Knowing where the pressure points are — for both GPs and lenders — separates smart decisions from risky ones.

For GPs and Fund Managers: Flexibility, But With Friction

For fund managers, NAV lending can be a lifeline when capital is tight. But it comes with strings attached. A NAV loan becomes senior debt. It must be repaid before investors get distributions. This reduces flexibility if markets shift or cash flows drop.

Cross-collateralization can also be a double-edged sword. It helps unlock value across the portfolio. But it also means one weak company can impact repayment for the whole fund. If more than one holding struggles, the pressure builds fast.

Regulatory scrutiny is growing. The SEC’s 2025 Examination Priorities include a close look at NAV loans. They are questioning valuation methods, leverage limits, and possible conflicts of interest. For example, managers might be tempted to overvalue assets to borrow more. If not handled openly, this can damage trust and create compliance issues.

For GPs, it’s not just about getting cash. It’s about doing it transparently, with strong controls and clear communication. Getting it wrong can harm both reputation and investor relationships.

For Lenders and LPs: Structured, But Not Risk-Free

Lenders usually hold a senior position in the repayment order. But they are still exposed to risk. NAV loans sit below debt at the portfolio company level. That means companies pay their own lenders first. Only then does capital flow back to repay the NAV loan.

This distance from the operating cash matters if companies struggle. Lenders must also judge the quality of the collateral. NAV loans are backed by full portfolios, not single assets. That requires strong underwriting and realistic valuations. Overestimating portfolio strength can lead to losses.

The risk of total collapse is low. Since 1990, only about 5% of private equity funds have returned less than 0.5x. Even in the 2008 crisis, private equity fell around 25%, compared to a 45% drop in public markets. That history offers some comfort — but not a reason to skip due diligence.

Lenders also face legal and operational challenges. Fund documents must allow NAV borrowing. Protections need to be built in, such as:

- Limits on total fund debt

- Minimum portfolio size and diversification rules

- Automatic repayment triggers if loan-to-value ratios rise too high

- A stop on investor distributions if the fund breaches key terms

These safeguards protect the lender. They also help keep the fund stable in rough markets.

FAQs About NAV Lending

What exactly is NAV lending, and why are people talking about it now?

NAV lending happens when a private equity fund borrows money. The loan is backed by the value of its portfolio. It’s getting more attention because it’s harder to raise cash the usual way. Selling assets or going public is not as easy in today’s market. Instead of selling for less than they want, fund managers can take a NAV loan. This gives them cash while keeping control of their assets.

How does NAV lending help private equity fund managers?

It gives fund managers quick access to money. They don’t have to sell their top assets. They can use the money to grow portfolio companies. They can also pay off expensive debt or return money to investors sooner. This keeps the fund active, even when the market is slow.

Why are big players like Blackstone interested in NAV loans?

Large firms see NAV lending as a smart investment. They also see it as a way to support the funds they work with. It offers steady returns and lower downside risk. It also lets them be part of high-quality portfolios. For them, it’s a rare mix of stability and opportunity.

Is NAV lending risky for lenders?

It’s not risk-free. But it is built to be safer than many other loans. The loan is backed by the entire portfolio, not just one company. If one investment struggles, others can help repay the loan. Still, lenders need to check the portfolio carefully. They should also set clear rules to protect themselves.