We all recognize the value of life insurance, but it’s the kind of thing you take your time with. You pause. You ask questions. You look at pricing, read reviews, and compare what each company offers. If Ethos Insurance has caught your eye, here’s everything you need to know before deciding if it’s the right fit for you.

How Much Does Life Insurance from Ethos Cost?

If you’re curious about how much Ethos Insurance will cost, the truth is—it depends on you. Your age, health, lifestyle, and even where you live can all influence the final price.

Insurers base your rate on risk. That’s what Scott Holeman from the Insurance Information Institute says, too. It’s not just your medical history. They also look at your gender. They look at your job. They even consider your ZIP code. The healthier you are, the better your rate. The younger you are, the better your chances too.

With most traditional insurance companies, you’d have to take a medical exam to get started. But Ethos Insurance does things differently. Many people qualify without any exams at all. You just answer a few health questions online. No needles. No waiting rooms. It’s quick. It’s easy. It moves at your pace.

The type of plan you pick also matters. Term life insurance is usually more affordable. It covers you for a set period. That’s usually 10 to 30 years. Whole life insurance costs more. But it lasts your entire life. It also builds cash value over time. You can access that value if you ever need it.

Ethos works with trusted partners like Mutual of Omaha and Ameritas. They pull from multiple providers. That’s why they don’t post one-size-fits-all prices. Still, here’s a rough idea of what a healthy 40-year-old non-smoker might pay for a 10-year term policy:

| Coverage | Female | Male |

|---|---|---|

| $250,000 | $18/month | $19/month |

| $500,000 | $26/month | $32/month |

| $750,000 | $36/month | $45/month |

| $1,000,000 | $46/month | $58/month |

These numbers are just estimates. Your actual price might be lower. Or it might be higher. It all depends on your personal details. It also depends on the insurer Ethos matches you with.

How Does Ethos Insurance Compare to Other Life Insurers?

Are you thinking about going with Ethos Insurance? You’re not alone. With so many life insurance companies out there, it’s smart to compare.

While life insurance prices stay fairly steady, the experience can feel very different. Some companies focus on flexibility. Others aim to keep things fast and simple.

Whether you want the lowest premium, a personalized policy, or just a smoother buying process, here’s how Ethos Insurance stacks up against some big names.

Ethos Insurance vs. MassMutual

If you like customizing every detail, MassMutual gives you more room than Ethos. They offer riders like accelerated death benefits and long-term care coverage.

They also have a mobile app to help manage your policy. But their process is still pretty traditional. You might have to fill out forms or make calls to get started.

Ethos Insurance, on the other hand, keeps things fully online. From quote to coverage, it’s fast and paper-free. If convenience matters most, Ethos keeps it simple.

Ethos Insurance vs. State Farm

State Farm is known for great service and local agents. They’ve been named the Best Term Life Insurer by Bankrate two years in a row. And they offer solid customization options.

If you prefer sitting down with an agent, State Farm is a great pick. But they only sell their own policies.

Ethos Insurance works with multiple top-rated insurers. That means more choices for you—and less work. You apply once, and Ethos helps find the best match.

Ethos vs. Guardian

One reason many people turn to ethos life insurance is the no-exam policy options — and if that’s your top priority, Guardian might be another name worth considering. They also offer several no-exam life insurance options and are available in all 50 states plus Washington, D.C.

That last detail matters, especially if you’re shopping for life insurance in New York, where Ethos isn’t currently available. Guardian also has a strong reputation for long-term support and policy stability.

However, if you’re looking to compare whole life coverage online, Guardian might come up short. They only allow online quotes for term life policies, while Ethos makes both term and whole life policy info more accessible from your screen.

Is Ethos a Good Insurance Company?

Technically speaking, Ethos isn’t a life insurance company — it’s a licensed agency. That means it doesn’t underwrite the policies itself. Instead, it works with well-known insurers like Mutual of Omaha, Ameritas, and AAA Life to match you with the right coverage.

Still, for a lot of people, Ethos life insurance is a solid choice — especially if you want to apply entirely online without the usual hassle. Many policies are available without a medical exam, and most people can complete the application in under ten minutes. If speed, convenience, and a no-pressure process are high on your list, Ethos does those things well.

If you prefer a little personal guidance, there’s also the option to work with a local agent who partners with Ethos — though availability can vary depending on where you live.

One thing to keep in mind: since Ethos isn’t the company behind the actual policy, your overall experience will partly depend on which insurer you’re paired with. That includes things like claims processing and long-term service. So it’s a good idea to do a quick check on the company underwriting your plan before you commit — just to make sure it aligns with what you’re looking for.

In the end, Ethos offers a fast, simplified way to get covered — and for many people, that’s exactly what they need.

Ethos Tools and Extra Benefits

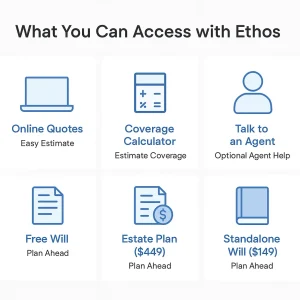

Ethos Insurance is known for being fast and easy. You can get a quote online in just a few minutes. But there’s more to it than that. Ethos also works with licensed agents and brokers. If you prefer talking to someone in person, that’s possible in many areas.

This can help if you’re unsure about coverage or need guidance. You can also use their online calculator to get a quick estimate. It’s fast, simple, and pressure-free.

Ethos offers more than just life insurance. You’ll also find tools for estate planning and writing a will. These extras help make life’s big decisions feel easier.

Here’s what else Ethos brings to the table:

- Free Will with Eligible Policies: If you purchase a qualifying life insurance policy through Ethos, you’ll get access to a free will and basic estate planning tools. It’s a small but meaningful benefit, especially for anyone who hasn’t gotten around to creating one yet.

- Standalone Wills Starting at $149: Even if you don’t buy a policy, Ethos still lets you create a legally valid will online for as little as $149. The process is straightforward — usually takes about 10 minutes — and includes video guidance to walk you through each step.

- Online Estate Plan for $449

For more comprehensive planning, Ethos also offers an estate planning package that includes a will, a power of attorney guide, and caregiving information. If you’re not an Ethos policyholder, you can make edits to your plan for free for two years. After that, updates cost $19 per year for wills or $39 per year for full estate plan changes.

FAQs About Ethos Insurance

1. How much does life insurance from Ethos cost?

It depends on you. Ethos looks at your age, health, lifestyle, and location. Younger and healthier people usually get lower rates. They don’t list fixed prices, but quotes take minutes. A healthy 40-year-old non-smoker might pay around $46/month for a $1 million, 10-year term plan.

2. Do I need a medical exam with Ethos Insurance?

Usually, no. Many people qualify without it. Just answer a few health questions online. No needles. No appointments. You could get covered the same day.

3. How does Ethos compare to State Farm or MassMutual?

Ethos keeps things simple and online. No agents. No paperwork. MassMutual and State Farm offer more in-person help, but the process takes longer. Ethos gives you fast coverage with more choice.

4. Is Ethos a real insurance company?

Ethos is a licensed agency, not an insurer. They partner with trusted companies like Mutual of Omaha and Ameritas. You apply through Ethos, and they match you with the best fit.

5. What extra tools does Ethos offer?

Ethos includes extras like free wills with some policies. You can also make a will online for $149. They offer full estate plans too. Everything is digital and easy to use.