If it feels like your paycheck disappears the minute it hits your bank account, you’re not imagining things.

From rent checks that rival mortgages to grocery bills that feel like luxury shopping sprees, the cost of living in California just keeps climbing. And while everything from gas to eggs gets more expensive, your debt? That’s quietly growing in the background too.

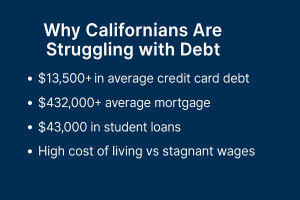

According to recent numbers, the average household in the Golden State carries more than $13,400 in credit card debt—the highest increase in the country. In total, Californians are now holding over $162 billion in credit card balances. That’s nearly $4.5 billion more than just a few months ago.

And it’s not just credit cards. Many residents seeking debt relief report carrying $16,977 or more in unsecured debt. The pressure is everywhere: rising rents, stagnant wages, and in some cases, layoffs or reduced hours. As Gary Herman from Consolidated Credit put it, “Rising rent and housing prices are crippling California residents who are already struggling to meet their credit card payments.”

So if you’re feeling overwhelmed, you’re far from alone—and you’re not out of options.

This guide will discuss some real, legal, and compassionate California debt relief programs. Whether you’re behind on bills or just trying to avoid that tipping point, we’ll show you practical paths to lighten the load—and start fresh.

Read More: What is Final Expense Life Insurance?

What Is California Debt Relief — And Who Needs It Most?

Living in California comes with plenty of perks—mild weather, coastline views, and innovation around every corner. But beneath the surface, many residents are carrying a heavy financial load—and the numbers paint a sobering picture.

According to recent data, more than 17,000 Californians filed for bankruptcy this year alone—a 25% increase from the year before. It’s the highest number the state has seen in four years. While bankruptcy is often a last resort, these rising filings reflect the mounting pressure many households are facing.

Unemployment is another concern. While California added over 100,000 jobs in the first half of 2024, the unemployment rate still hovers at 5.3%—one of the highest in the country. For many workers, job growth hasn’t translated into financial stability. And with the state not recognizing right-to-work laws, union dues remain mandatory in certain jobs, whether or not a worker is a union member.

Then there’s the cost of simply living here.

Housing remains one of the biggest challenges. The median price for a single-family home is now around $904,000—a number that feels out of reach for most first-time buyers. Rent isn’t much easier to manage, averaging $1,927 per month, with cities like Sacramento and Fresno now experiencing the same affordability struggles that once felt limited to the Bay Area or Los Angeles.

Even for homeowners, the average mortgage payment in California is now $2,576, and while a homestead exemption does offer some legal protection, it doesn’t solve the underlying affordability gap.

And while California boasts a high per capita income—around $81,255, compared to the national average of $69,815—the reality is that income doesn’t always stretch far in a state where the combined sales tax can reach up to 10.75% in certain cities.

Insurance and healthcare costs bring another layer of stress:

- Auto insurance: $2,810/year for full coverage

- Health insurance: $8,038/year—well above the national average

- Homeowners insurance: $1,250/year

These are real costs, hitting real families every month.

And when financial stress becomes unmanageable, basic needs start to fall out of reach. Food insecurity has grown, with regional food banks across Los Angeles, San Francisco, and Bakersfield stepping in to support families. California’s veteran population—over 1.5 million strong—also faces unique challenges, including unemployment, housing insecurity, and rising costs after service.

It’s a tough reality. But it’s not a hopeless one.

The good news is that California debt relief programs are designed with this financial landscape in mind. Whether you’re facing eviction, falling behind on utility payments, or feeling stretched by insurance costs, there are structured solutions available—and they start by understanding your options.

Top Debt Relief Programs for Californians in 2025

If you’re living in California and the pressure of unpaid bills has become more than just a background stress—it’s the kind that keeps you up at night—you’re not alone. Debt has become a harsh reality for thousands across the state. Between rising housing costs, job market fluctuations, and inflation pushing the price of basics higher, many Californians are searching for a real way out.

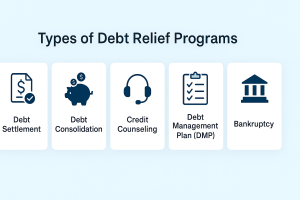

Here’s a breakdown of debt relief programs that are actually helping people regain financial stability in 2025. Each one comes with its own pros, trade-offs, and suitability depending on your financial situation.

1. Debt Settlement

Debt settlement might make sense if your debt feels too large to tackle on your own—and you’ve already fallen behind. The idea is simple: instead of paying your full balance, you negotiate with creditors to settle for less. This often means offering a lump sum or structured settlement that’s lower than what you originally owed.

For example, someone with $12,000 in credit card debt might be able to settle it for $6,000. While that’s a big relief, it’s not without consequences—your credit score could take a temporary hit, and the amount forgiven might be considered taxable income.

In California, laws like the Fair Debt Settlement Act and Assembly Bill 1405 help protect consumers from being taken advantage of. The state also requires debt settlement companies to wait until a settlement is reached before they charge fees.

This option works best if:

- You’re behind on payments and drowning in unsecured debt.

- You can put together a lump sum or commit to regular deposits in a settlement account.

- You’re aware of the short-term impact on your credit.

2. Debt Consolidation Loans

If your credit isn’t in terrible shape and you’re still able to keep up with minimum payments, consolidating your debts could bring much-needed relief. This approach rolls all your existing debts—credit cards, personal loans, etc.—into a single, manageable loan, ideally with a lower interest rate.

What you gain is clarity: one monthly payment instead of five or six. But the catch? You need good credit to qualify for favorable terms. And if you’re already struggling to stay current on bills, getting approved can be tough.

This option might fit if:

- You have a fair or good credit score.

- You’re looking for a cleaner, more structured way to pay off your debt.

- You’re not behind on payments—yet.

3. Credit Counseling & Debt Management Plans

If your problem isn’t necessarily how much you owe—but more about how to manage it—credit counseling could be a smart place to start. These nonprofit agencies help you take a full look at your budget, spending habits, and debt situation.

In some cases, they may suggest enrolling in a Debt Management Plan (DMP), where you make a single monthly payment to the agency, and they deal with your creditors. They may even be able to negotiate lower interest rates on your behalf.

But there’s a tradeoff: you’ll still repay the full balance, and the program typically runs for three to five years. Some people find it hard to stay committed that long.

This works well if:

- You’re committed to repaying what you owe but need help organizing the process.

- You’re dealing with multiple creditors.

- You want a more formal plan without borrowing more money.

4. Bankruptcy

No one wants to talk about bankruptcy, but when every other path feels blocked, it’s a legal safety net that’s there for a reason. In California, many residents turn to Chapter 7 (which wipes out most unsecured debts) or Chapter 13 (which structures a repayment plan over a few years).

Yes, your credit will take a serious hit, and it stays on your record for up to 10 years. But for those whose financial situation has reached rock bottom, bankruptcy can offer a clean slate.

Bankruptcy may be the right choice if:

- You’re facing lawsuits, wage garnishment, or foreclosure.

- You’ve exhausted other relief options.

- You understand the long-term implications and are prepared for a reset.

5. State & Community Programs

Beyond traditional debt relief options, California offers state-run and local assistance programs for residents facing financial hardship. These aren’t always labeled as “debt relief,” but they can help ease the pressure enough to get you back on your feet.

Here are a few examples:

- Mortgage and rent relief programs for homeowners and renters struggling to make payments.

- Utility bill assistance to help cover electric, gas, and water bills.

- Food banks and nutrition support for those dealing with food insecurity.

- Veteran aid programs for housing, job training, and emergency financial help.

These services often don’t get enough attention but can be lifesaving in the short term. Many are run at the city or county level, so check what’s available in your local area.

These programs are ideal if:

- You need immediate support with essentials like housing, food, or utilities.

- You’re waiting on a longer-term debt solution to kick in.

- You’re unsure where to start and need a safe entry point.

California Debt Relief Laws

California Debt Relief Laws Debt settlement is a highly-regulated industry at the federal level, but California has its own laws regarding debt relief companies, too.

What Is the California Fair Debt Settlement Act?

California passed the Fair Debt Settlement Act in 2022 to bring much-needed structure to an industry that had become known for taking advantage of vulnerable people. If you’re working with a debt relief company in California, here’s what this law guarantees:

- No upfront fees, ever. A company can’t charge you anything until they’ve actually negotiated a deal with one of your creditors—and you’ve made a payment on that deal.

- You get to read the fine print. Companies must give you a clear disclosure and an unsigned contract at least three days before asking for a signature.

- You get monthly updates. They must send you regular statements showing how much money has gone into your settlement account and where it’s gone.

- They have to be honest about the risks. Including how it might affect your credit score.

In short, the law makes sure you’re not left in the dark, paying into a program that may or may not deliver. It gives you the right to understand what you’re signing up for—before you sign.

Assembly Bill 1405: Your Right to Walk Away

On top of the Fair Debt Settlement Act, California passed AB 1405, which made the rules even clearer—and even more consumer-focused. This law:

- Gives you the right to cancel your agreement with a debt settlement company at any time without a fee (just give seven days’ notice).

- Allows you to take legal action if a company violates your rights under the bill.

For California residents, this bill means peace of mind. If a company makes you feel pressured, confused, or misled—you have options. You’re not stuck.

What About Collection Harassment?

That’s where the Rosenthal Fair Debt Collection Practices Act steps in. It’s California’s version of the federal FDCPA, but with even stronger protections.

Under this law, debt collectors can’t:

- Call you at unreasonable hours

- Threaten you with jail time

- Use abusive or manipulative language

- Contact you at work if you’ve told them not to

If they cross the line, you can sue—and many Californians have. You’re not powerless.

Statute of Limitations: How Long Can They Chase You?

A lot of people don’t know this, but debt doesn’t follow you forever. In California, creditors have a limited window to sue you:

- 4 years for written contracts like credit cards or medical debt

- 2 years for verbal agreements

Once that window closes, they can still try to collect—but they can’t take legal action. Knowing these deadlines helps you protect yourself from unfair threats or pressure tactics.

When Bankruptcy Becomes the Only Option

Bankruptcy isn’t something anyone dreams of filing. But for some Californians, it can be the clean break they need to start again. The state courts handle this process carefully—and require you to meet specific steps before you’re eligible.

Chapter 7 Bankruptcy – Full Discharge

- Best for those with little or no disposable income

- You may lose some non-essential assets, but most Californians keep their home and car

- Wipes out unsecured debt like credit cards or medical bills

- Stays on your credit report for up to 10 years, but can be the beginning of a rebuild

Chapter 13 Bankruptcy – Structured Repayment

- Meant for people who still have a steady income

- Sets up a court-approved payment plan over 3 to 5 years

- Can help stop foreclosure, reduce overall debt, and catch up on missed mortgage payments

- Usually a better fit for homeowners or families trying to stay afloat while paying things down

And yes—California law requires you to:

- Take credit counseling before filing

- Complete a financial management course after filing

- File detailed financial disclosures and meet with a court-appointed trustee

Fees vary: $306 for Chapter 7, $281 for Chapter 13.

Where to Start Your Debt Relief Journey

If you’ve been staring at your budget wondering what else there is to cut—or if you’ve been scraping by just to make the minimum payments each month—you’re not alone. With the cost of living climbing and interest rates showing no mercy, it’s no wonder so many Californians are searching for a way out.

But here’s the thing: You don’t have to figure it out alone. And you don’t have to sign anything to get started.

Let’s walk through where real help begins—without pressure, without contracts, and without shame.

Start with People Who’ve Walked Others Through This

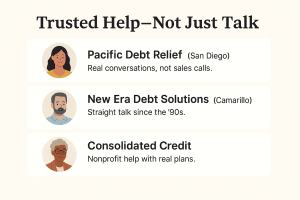

Not every debt relief company is out to help—but some have built a reputation by showing up for people when it matters most. These aren’t faceless corporations making wild promises. They’re organizations with real teams who’ve worked with thousands of Californians just like you.

- Pacific Debt Relief (San Diego): Known for their straightforward, no-fluff approach. Many clients say the first conversation felt less like a sales pitch and more like someone finally understood what they were going through.

- New Era Debt Solutions (Camarillo): Around since the ’90s, they’ve stayed true to one goal—transparency. They break down what’s realistic, what’s risky, and what could actually work. No scare tactics. No hidden terms.

- Consolidated Credit: A nonprofit that focuses on credit counseling and debt management plans. If you’re unsure where to begin, this is often where financial advisors point people who want clear options, not contracts.

Don’t Overlook the Free Help Already Available

Sometimes the most trustworthy help doesn’t come with a price tag. California has state-backed and nonprofit resources that offer real guidance—no catch, no pressure.

- California Department of Financial Protection & Innovation (DFPI): Think of them as the watchdogs. Their site helps you verify whether a debt relief company is legit and licensed—and shows you what your rights are under California law.

- HUD-Approved Credit Counselors: These counselors are trained to help people map out their financial mess, create workable budgets, and review options for getting out of debt. And yes—they’re free.

- CalVet Services: If you’re a veteran or part of a military family, CalVet connects you to programs specifically designed to ease financial stress. That might include debt help, housing support, or short-term emergency funding.

- Food Banks & Utility Aid Programs: It may not be the first thing you think of, but freeing up money by lowering grocery or energy bills can give you more breathing room to pay off debt. California’s network of local aid programs is one of the strongest in the nation.

Still Not Sure Where You Stand? Talk First. No Contracts. No Strings.

Here’s the truth: the first step in your debt relief journey should be a conversation, not a commitment.

Every reputable debt relief organization should offer a free consultation. This isn’t a sales call—it’s a chance to talk about your debt, your goals, and what you’ve already tried. From there, you’ll get a clearer sense of what path might actually work.

And if it doesn’t feel right? You walk away.

When you talk to someone, ask questions like:

- Will this affect my credit, and how long will it last?

- What fees do you charge, and when are they due?

- What happens if one of my creditors doesn’t agree to settle?

If they dodge those questions or sound too rehearsed, trust your gut. You deserve real answers.

One Step Forward Is Still a Step

No, you didn’t ask for this. You didn’t plan to get buried in bills. And you’re not failing just because you’re struggling.

Debt relief in California can feel complicated—but there’s a map. And there are people who’ve helped others follow it.

Start small. Ask questions. Don’t be afraid to get help. Because getting back on track doesn’t begin with a perfect plan—it starts with the decision to try something different.

And that first step? It’s free.

FAQs:

Do you have a legitimate financial hardship condition?

Many debtors in California become buried in debt because of a loss of income, medical issues, or divorce / separation. All three of these situations qualify as legitimate financial hardships that can happen to anyone through no fault of their own, and each one can spell serious trouble for your household budget.

A Debt Settlement program is not a “get out of jail free card” for people who want to skip out on paying their debts, but if you are feeling financially overwhelmed due to a hardship circumstance, and you’re looking for an alternative to filing for bankruptcy in California, then Debt Settlement can provide an honest and ethical debt relief alternative.

Are you committed to being free of debt in California?

Debt Settlement is an aggressive approach to debt relief, but it is one of the most effective ways of reducing your total debt in California, but settlement is only viable for those who are fully committed to clearing debt from their name. For those who are willing to stick with the program, California debt settlement can get you back even more quickly and at a lesser cost than other forms of debt relief.

Is Your Debt in California Primarily from Credit Cards?

Most types of unsecured debt can be negotiated in California including lines of credit, signature loans, repossession deficiencies, financing contracts, department store cards, miscellaneous bills and more. However, the largest debt reductions are often found with credit card debt; so, if most of what you owe is unsecured debt from credit cards, you expect good results with California debt settlement.

How much can I save through a California debt settlement program?

Savings vary, but most successful debt settlement programs can offer somewhere between a 20-50% reduction in the total owed after fees.

Can debt settlement stop collection calls?

While debt settlement does not automatically stop collection calls, creditors may cease collection efforts once negotiations begin or a settlement is reached.