What happens when private equity funds need cash, but selling off prized assets feels like giving up too soon? In a market where exits are slower and investor capital is tighter, fund managers are turning to a tool that was once niche but is quickly becoming essential: NAV lending.

NAV loans offer a smart alternative to fire sales or equity dilution. Instead of breaking up a well-built portfolio, fund managers can borrow against the net asset value of their existing investments — unlocking liquidity without giving up control. It’s a solution that blends financial flexibility with strategic patience, and it’s changing how private equity operates behind the scenes.

But NAV lending isn’t just a shortcut to cash. It’s a carefully structured, often covenant-heavy agreement with risks, rewards, and regulatory attention. As this financing option grows, it’s attracting everyone from top-tier GPs to global credit funds, all trying to find balance between performance and liquidity in today’s uncertain market.

In this guide, we’ll discuss how NAV lending works, who it serves, and why it’s quickly becoming a mainstay in fund-level finance — not just a stopgap. Whether you’re a GP looking for breathing room or an LP trying to understand the implications, you’re in the right place.

Read More: Are Tax Free Municipal Bonds Still a Solid Bet for Conservative Investors?

What Is NAV Lending?

Imagine you’ve built a private equity fund filled with strong, promising businesses. You’ve worked hard, your investors have already put in their money, and most of that capital has been used. But now, a new opportunity shows up — or maybe one of your companies needs more support to grow.

You need cash, but you don’t want to sell off part of your portfolio or give up ownership. So, what do you do?

This is where NAV lending comes in.

NAV lending lets fund managers borrow money by using the value of their existing investments as collateral. Instead of selling anything, they borrow against what they already own. The “NAV” — or net asset value — is just the total value of the fund’s companies, minus any debts. That’s what backs the loan.

Think of it like taking out a loan on a house you already own. You’re not selling your home — you’re just using its value to access some cash.

Most of the time, NAV loans are used later in the life of a fund. By then, investor money has already been spent, but new needs or opportunities come up. A NAV loan gives the fund breathing room — a chance to invest more, support a growing company, or simply wait for a better exit.

Every NAV loan is customized, but here’s what’s usually true:

- The loan is small compared to the total value — about 10% to 30% of the fund’s NAV

- It’s repaid over 3 to 5 years, using profits from future company sales

- No new investors are needed — the money comes from within the fund

These loans don’t come from just any bank. They’re usually offered by credit funds, insurance firms, or specialized lenders who really understand private equity.

Let’s make it real with an example.

Say a fund owns a group of companies worth $200 million, but it also has $20 million in debt. That gives the fund a NAV of $180 million. The manager wants to invest in something new, but there’s no investor capital left.

So they talk to a lender. After reviewing everything, the lender agrees to provide a loan worth 20% of the NAV — that’s $36 million. The NAV backs the loan, and the fund now has fresh capital to work with — without having to sell anything or lose control.

NAV lending is useful not just because it gives funds flexibility, but because of when it helps — when managers have built value, but just need more time or cash to fully realize it.

In the end, NAV lending isn’t about taking on risky debt. It’s about keeping the fund’s momentum going — giving managers a chance to finish what they started.

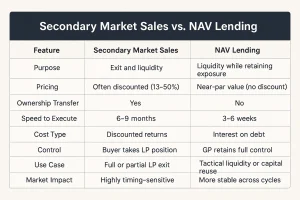

NAV Lending vs. Secondary Market Sales

When private equity investors need liquidity, the traditional route has always been the secondary market. That’s where LPs sell off part or all of their stake in a fund — often at a discount — to free up cash. But lately, that path has become less appealing.

With M&A and IPO activity slowing down, capital distributions are drying up. At the same time, many LPs are over-allocated to private equity and under pressure to rebalance. They need cash now — but selling their positions in a down market often means taking a painful loss. And frankly, many just aren’t willing to do that anymore.

Secondary sales tend to come with a haircut, especially when markets are volatile. Investors don’t always agree on price, and in tight conditions, buyers gain leverage. On average, discounts in the private equity secondary market hovered around 13% in late 2022 — and in some corners, like early-stage venture capital, sellers have been forced to part with assets at discounts as deep as 50%. That’s not just a haircut. That’s a full-blown trim you feel in your long-term returns.

This is where NAV lending changes the story.

Instead of settling for a fire sale, fund managers and LPs can borrow against the full value of their holdings. NAV lending allows them to access liquidity at or near par — without giving up ownership, and without locking in losses. The NAV becomes the reference point for the loan, not a negotiable price that gets chipped away in backroom bids.

It’s a smoother process, too. There’s no haggling over discounts, no transfer of ownership, and no rush to meet a buyer’s timeline. The lender doesn’t need to control the asset — just trust the value of the underlying portfolio and the quality of the fund’s track record.

And timing? That’s another major advantage. While a secondary sale might take six to nine months to close — dragging through due diligence and paperwork — a well-structured NAV facility can be completed in just weeks. That speed gives managers flexibility to move when it matters most.

Still, secondaries have their place. They’re easy to explain, especially inside institutions where a simple sale looks cleaner on paper. But in many cases, NAV lending is the smarter move. It keeps the investor in the game, preserves potential upside, and avoids the kind of discount that turns long-term value into short-term regret.

For managers and investors alike, NAV lending isn’t just a workaround. It’s a signal — that you believe in what you’ve built, and you’d rather borrow some time than surrender your best assets under pressure.

Explore it too: Treasury Bills vs Bonds: What Every U.S. Investor Should Know in 2025

Why NAV Lending Is Gaining Traction

It’s no secret that the private equity world is facing a moment of reckoning. For years, the industry rode a wave of high returns, active exits, and eager investors. But today? The landscape feels different. Capital is harder to move. Exit doors have narrowed. And the once-reliable cash distributions are now trickling in slower than many expected.

Since 2019, global private equity assets under management have nearly doubled, ballooning to around $10 trillion. That kind of growth creates pressure — especially when paired with rising interest rates, inflationary shocks, and a slowdown in IPOs and M&A deals. Fund managers are sitting on valuable assets, but converting them to cash without eroding long-term value has become increasingly difficult.

This is where NAV lending has found its moment.

As traditional liquidity routes tighten, NAV loans are stepping in to fill the gap. By borrowing against the portfolio’s net asset value, fund managers can access capital without selling at a loss or giving up control. It’s a practical, non-dilutive option in a world that’s suddenly short on flexibility.

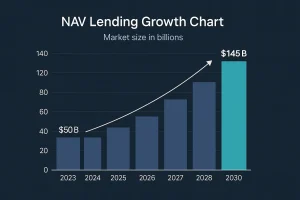

And investors are paying attention. The NAV lending market, which was estimated at around $50 billion in 2023, is projected to nearly triple to $145 billion by 2030. That kind of growth doesn’t happen by accident — it happens when a financing tool moves from niche to necessary.

What makes this rise even more notable is that NAV lending isn’t just a temporary fix. It’s becoming a standard option in the playbook — a tool used not just in times of stress, but as a proactive strategy to keep capital flowing, even in uncertain conditions.

How NAV Loans Work

When a private equity fund has already deployed all of its committed capital but still sees an opportunity worth acting on, traditional funding options might not be enough — or even available. Raising new equity can be slow and dilutive. Selling off a strong asset can interrupt long-term strategy. That’s exactly where NAV loans step in — not as a backup plan, but as a smart, purpose-built solution that taps into the value the fund has already created.

Imagine a fund managing a portfolio of companies collectively worth $200 million. However, it also carries $20 million in liabilities — leaving it with a net asset value (NAV) of $180 million. That NAV becomes the key that opens new doors. Instead of exiting an investment prematurely or waiting for markets to thaw, the fund can borrow a portion of that NAV — often between 10% and 30% — and use the loan to stay on course or seize the next big opportunity.

Let’s say the lender agrees to provide 20% of the NAV. That would mean $36 million in fresh capital. It’s not coming from new investors or asset sales — it’s money borrowed against the strength of the portfolio itself. The loan is secured across the entire fund, not tied to a single company. And most importantly, it allows the manager to act without losing control.

NAV loans aren’t repaid out of thin air. Instead, the fund pays the lender back using the cash flows generated by its own portfolio. This might come from selling a company, receiving dividends, or other monetization events. Because repayment is built into the fund’s natural lifecycle, managers aren’t forced to divert focus or scramble for external capital.

The loan term is typically three to five years, giving the fund enough breathing room to deploy capital wisely and repay without pressure. Interest rates are often floating — they move with the broader market — and repayment timelines are structured with the fund’s expected liquidity in mind.

No two NAV loans are exactly alike. These are not off-the-shelf products — they’re handcrafted to suit the specific shape, size, and strategy of each fund. Some portfolios may include five companies, others twenty. Some may have steady cash flow, while others are still building value. Lenders take all of this into account and tailor the loan terms accordingly.

The collateral typically includes a diversified mix of portfolio companies — rarely just one — which helps manage risk. If one asset stumbles, others in the fund can offset the impact. This collective backing is what makes NAV lending different from traditional asset-level debt: it’s based on the total strength of the portfolio, not the performance of a single investment.

Because NAV loans are backed by the entire fund, lenders often include protective terms known as covenants. These guardrails help reduce risk and ensure that the fund remains stable throughout the loan’s life.

For example, lenders might limit how high the loan-to-value (LTV) ratio can go. If the fund’s value drops and the LTV spikes, the manager could be required to repay the loan early or make other adjustments. There may also be minimum requirements for the number of active portfolio companies — to ensure the fund stays diversified. And if the fund ever defaults, the lender typically receives repayment before any distributions are made to investors.

NAV loans are often cross-collateralized, meaning the entire portfolio supports the loan. That’s a powerful structure for lenders — but also a responsibility for managers, who must keep the full fund performing well, not just one or two standout companies.

There’s one more layer worth mentioning — and it’s an important one. Not all private equity funds are automatically set up to take on NAV debt. If the original Limited Partnership Agreement (LPA) doesn’t allow for fund-level borrowing, the manager may need to seek approval from the LP advisory committee or amend the fund documents before closing the deal.

This isn’t just a formality — it’s about trust, transparency, and protecting investor interests. Everyone involved needs to understand what the NAV loan means, how it’s structured, and how it will be repaid. That clarity ensures alignment from day one.

Use Cases of NAV Lending for GPs

In today’s private equity environment, general partners (GPs) are under increasing pressure to deliver strong results — even when markets are tight and liquidity is hard to come by. That’s where NAV lending becomes more than just a financial tool. It becomes a flexible, strategic option for GPs to navigate challenges and act with confidence, without giving up control or compromising long-term value.

Providing Liquidity Without Sacrificing Equity

For many GPs, one of the biggest advantages of NAV lending is that it provides non-dilutive capital — meaning they can raise funds without having to give up equity or bring in outside partners. This is especially valuable when a portfolio company is growing fast and needs follow-on investment, or when there’s a chance to make a smart add-on acquisition that wasn’t planned for at the fund’s launch.

Instead of scrambling for fresh capital or selling a stake too early, GPs can borrow against the NAV of their existing portfolio and keep their ownership structure intact. That allows them to stay focused on building value, rather than reacting to short-term funding gaps.

It also helps avoid situations where a GP feels pressured to exit a high-performing company too soon just to raise cash. With NAV lending, they don’t have to walk away from upside — they can stay the course and let the investment mature, while still having liquidity to work with elsewhere.

Managing Commitments and Enhancing Returns

NAV loans can also play a vital role in helping GPs meet their own financial commitments — especially as fund sizes grow and GP stakes become more substantial. A perfect example is KKR’s $1 billion commitment to its European buyout fund, which was partially funded through internal financing mechanisms like NAV-based solutions.

When GPs are able to access this kind of support, it signals strength and alignment — they’re backing their own funds with real skin in the game, which sends a strong message to LPs.

On a broader level, NAV lending enables what many GPs call capital recycling — taking distributions or unrealized value and putting it back to work inside the fund. This allows the manager to act quickly on new opportunities, even when LP capital has already been fully deployed. In a competitive market, that agility can make all the difference.

Funds that can keep capital moving — without having to pause, liquidate, or raise new rounds — are often the ones that outperform. And for GPs looking to stand out to LPs in their next fundraising cycle, being able to say, “We made more happen with the same resources,” is a powerful story.

Regulatory and Disclosure Obligations

As NAV lending continues to gain traction, it’s also drawing more attention from regulators and industry bodies. While this form of financing offers genuine flexibility for private equity funds, it also introduces new responsibilities — especially when it comes to how borrowing is disclosed, documented, and governed. Fund managers are no longer just managing capital — they’re being called to manage expectations, regulations, and reputations.

SEC and ILPA Focus on Fund-Level Borrowing

NAV loans have become a focal point for both the Securities and Exchange Commission (SEC) and the Institutional Limited Partners Association (ILPA) — and it’s easy to see why. These loans change the traditional dynamics of fund leverage. They’re not tied to a single portfolio company, but to the fund as a whole — which creates a new layer of complexity and risk if not handled properly.

The SEC’s 2025 Examination Priorities have placed fund-level borrowing — including NAV lending — under direct review. Their concern centers on two things: valuation practices and the use of leverage. If a manager overstates a fund’s NAV in order to secure a larger loan, that’s a serious conflict of interest — one that could leave both LPs and lenders exposed.

In parallel, ILPA continues to emphasize the need for strong governance, transparent documentation, and clear disclosure when it comes to NAV facilities. If a fund’s Limited Partnership Agreement (LPA) doesn’t explicitly allow for NAV-based borrowing, then consent from the LP advisory committee (LPAC) is typically required. Skipping that step — or rushing through it — could erode trust, even if the loan itself is well-intentioned.

Best Practices for Managers

In a regulatory environment that’s growing more watchful, fund managers need more than just good intentions — they need clear, well-documented processes that show exactly how NAV loans are being managed and why they make sense for the fund.

That starts with robust valuation procedures. The way NAV is calculated must be consistent, grounded in reality, and thoroughly backed by data. These valuations should stand up to scrutiny — not just from regulators, but from LPs, auditors, and the lending partners themselves.

Managers must also be upfront about any fees, potential conflicts of interest, and the specific risks associated with NAV lending. That includes clarifying who benefits from the loan, what protections are in place, and how the borrowing aligns with the fund’s original strategy.

And perhaps most importantly, there needs to be ongoing communication with LPs. A one-time disclosure isn’t enough. LPs should be kept informed about the status of the loan, its impact on fund performance, and any changes that may affect their distributions or returns. Frequent, open updates go a long way in building lasting trust — especially during periods of uncertainty or market stress.

In today’s climate, transparency isn’t just a legal checkbox — it’s a sign of leadership. When fund managers handle NAV lending with clarity and integrity, they don’t just meet the bar — they raise it. And in doing so, they strengthen their relationships with both regulators and investors alike.

Learn more about NAV Lending Via this Video

The Future of NAV Lending

NAV lending is no longer just an interesting option on the sidelines — it’s steadily becoming a core feature of modern fund financing. As traditional exit routes grow narrower and capital becomes harder to unlock, private equity managers are no longer asking if they should consider NAV loans. They’re asking how soon.

Recent trends reflect this shift. NAV lending activity is picking up notably among mid-market private equity managers, especially those holding onto assets longer than originally planned. These aren’t distressed sellers or desperate borrowers — they’re smart managers looking for liquidity tools that let them stay focused on value creation. In many cases, a NAV loan is what allows them to hold strong-performing companies just a bit longer or act on strategic opportunities that don’t fit the old calendar.

And the lending landscape is responding. What used to be the domain of a few specialist firms has now expanded to include banks, private credit funds, and even insurance companies — all competing to offer capital with flexible structures and tailored terms. That influx of providers is improving pricing and giving fund managers more choice than ever before. Even some limited partners, who once viewed NAV loans with suspicion, are now recognizing them as pragmatic tools rather than red flags.

But this growing popularity also brings new pressure.

As NAV lending moves from boutique to mainstream, regulators are stepping in with sharper questions and tighter expectations. Fund-level borrowing changes the financial profile of a vehicle in ways that aren’t always visible on the surface — and transparency is now non-negotiable. That means clear disclosures, consistent reporting, and an honest accounting of both risk and reward.

The SEC and industry bodies like ILPA are keeping a close eye on how NAV loans are being used, particularly in relation to valuation practices and leverage limits. Fund managers who embrace NAV lending will need to prove that they’re not just using it as a quick fix — but as a well-integrated, strategically sound component of their broader financing strategy.

At its core, this evolution is healthy. It’s pushing the private equity world to grow up a bit when it comes to liquidity planning. NAV loans aren’t replacing exits — they’re complementing them. They give funds more control over timing, which in today’s unpredictable market, is an advantage no one should underestimate.

Looking ahead, the managers who navigate this landscape with discipline, transparency, and purpose will likely emerge stronger. They won’t just have access to capital — they’ll have the trust of LPs, the confidence of lenders, and the ability to act boldly when opportunity knocks.

FAQs

1. What is a NAV loan?

A NAV loan is a type of financing that allows private equity funds to borrow against the net asset value (NAV) of their portfolio. Instead of selling off assets or raising new capital, fund managers use the value of their existing holdings as collateral to access liquidity. It’s often used in the later stages of a fund’s life to support ongoing investments, extend holding periods, or return capital to LPs sooner.

2. What is a NAV loan in private equity?

In private equity, a NAV loan is more than just financing — it’s a lifeline when liquidity gets tight. These loans are secured by a mix of portfolio companies and don’t require giving up equity, which makes them especially attractive. GPs often use them to back follow-on investments, refinance costly debt, or simply buy time when exit markets are slow. The loan is typically paid back using proceeds from company sales or dividends, not by dipping into new investor commitments.

3. Explain how NAV-based lending works in fund financing.

NAV lending starts with a simple idea: if your fund owns valuable assets, you can borrow against them. First, the fund calculates its NAV — the total value of its holdings minus liabilities. A lender then steps in, offering a loan based on a percentage of that NAV — usually somewhere between 10% and 30%. The loan gets secured by the portfolio itself, often spanning 5 to 20 companies. It’s repaid from future profits or distributions. With structured safeguards and covenants in place, it’s a way to unlock cash without dismantling the fund’s strategy.

4. Why are NAV loans becoming more common in private equity?

In today’s market, traditional exits are taking longer — and private equity firms need ways to stay nimble. That’s where NAV loans come in. They give GPs access to capital exactly when they need it most, without having to sell great assets at a discount. Whether it’s to fund a promising acquisition or support a company through a rough patch, NAV lending provides strategic liquidity. And as more lenders enter the market, better terms and more flexible deals are making this tool hard to ignore.

5. What are the risks and regulatory concerns with NAV lending?

Like any powerful tool, NAV lending needs to be used carefully. One big risk is overreliance — borrowing too much could backfire if portfolio values drop. Also, NAV loans sit below the company-level debt in the repayment line, so they’re not entirely risk-free. Regulators like the SEC are now paying closer attention, especially to how assets are valued and how risks are disclosed to investors. That’s why transparency, conservative structuring, and good communication with LPs are more important than ever.